On May 28, 2022, the developers of the crypto project Terra launched a second version of the network. In the background of the launch, officials of the platform organized an airdrop of LUNA tokens.

Why do you need Terra 2.0

In early May 2022, Terra’s algorithm stablecoin, TerraUSD (UST), lost its link to the base asset, the US dollar. Against the background of the fall of the «stable coin» the course of the native token of the project — LUNA — also rushed to zero. As a result, cryptocurrency investors suffered losses.

The reasons for the loss of UST parity with the US dollar are still uncertain. The developers do not rule out that stablecoin could be put under pressure by the financial giants BlackRock and Citadel. Another version is the loss of TerraUSD’s peg to the US dollar on the background of the withdrawal of a large amount of funds from the Anchor protocol, through which market participants could profitably stake UST.

The Terra team tried to restore the project with additional funding. Unfortunately for the developers, the plan did not work. After a failed attempt to recover Terra, the project team decided to restart the platform.

Terra 2.0 was launched on May 28. On the same day, the developers sent out the first part of LUNA 2.0 tokens to UST and LUNA investors. At the same time, the project team renamed the old version of the protocol as Terra Classic. The new network will work under the name Terra.

Terra 2.0 two days after launch

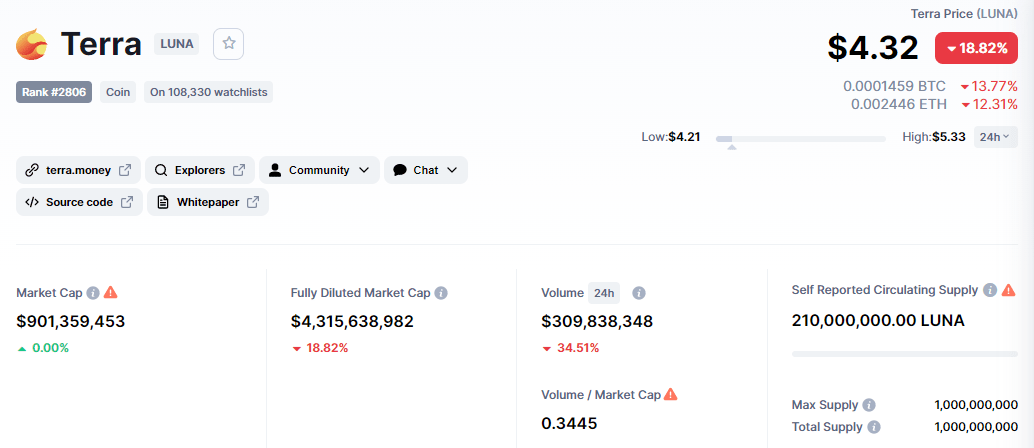

The post on the official launch of Terra 2.0 appeared on the microblog of the project on May 28, 2022. In parallel to the launch of the network, the developers released a new version of LUNA tokens. The issue of coins is limited. In total, 1 billion tokens will be released.

Large digital asset market data aggregators, including CoinMarketCap, have introduced LUNA 2.0.

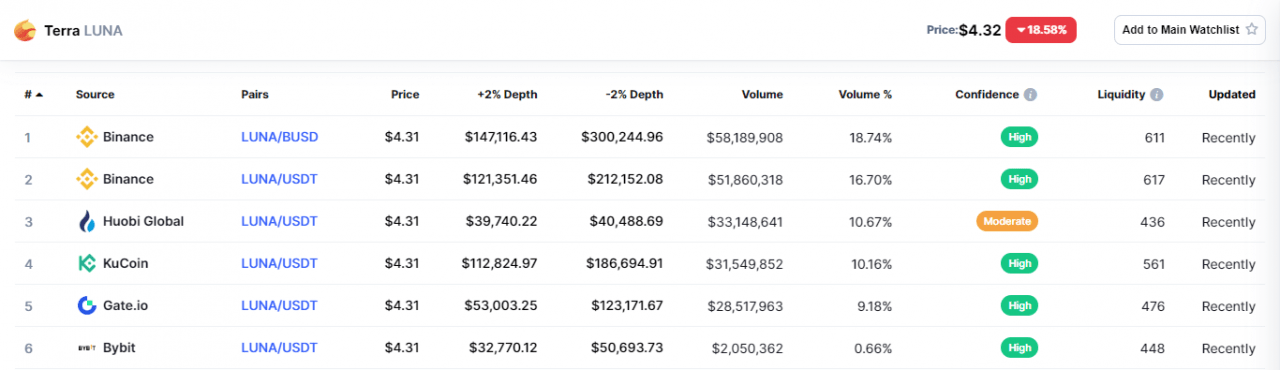

Many crypto exchanges quickly added the coin to their listing. You can buy LUNA, for example, on KuCoin, Huobi or Kraken.

The first version of the LUNA ticker was renamed LUNC, and the coin chain was renamed Terra Classic. The TerraUSD project was renamed TerraClassicUSD (USTC).

How did the LUNA Airdrop perform

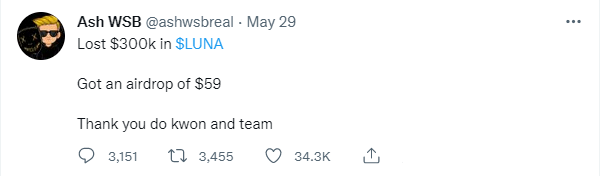

Many participants in the crypto community shared information that they had received tokens as part of the LUNA Airtrope. However, the users of the network consider the distribution unfair.

Lost $300,000 in LUNA. Received $59 through airdrop. Thanks to you, Do Kwon (founder of Terra) and the project team», — this was the result of the hand shared popular in the crypto community trader, leading twitter account under the nickname Ash WSB.

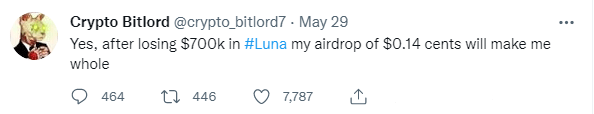

Many crypto industry members have also complained about unfairly small payouts for Airdrop. For example, a prominent analyst who runs a twitter called Crypto Bitlord said he got $0.14 in his hand. His real losses in the LUNA were $700,000.

Recall that many investors in the Terra ecosystem received 30% of the amount of tokens they were entitled to during the generation of the first block in the new project network. The rest, according to the developers, users will receive within two years.

What market participants think about Terra 2.0

Many representatives of the crypto industry are dissatisfied with the results of the launch of Terra 2.0, as the airdrop did not help them recover the losses they suffered in the background of the incident with UST.

Experts believe that restarting will not help the Terra team to revive the project. They explained that the developers had lost one of the main features of a possible success of Terra 2.0 — the trust of users.

Many market participants share the same view. For example, Bone Fide Wealth Consulting Company President Douglan Bonepart believes that investors should avoid Terra 2.0.

«If you like to lose all money with LUNA 1.0, you will also like to lose money with LUNA 2.0», — he wrote on his twitter.

The authors of the Fintwit project, in turn, drew attention to the injustice. In 2009, investors lost over $60 million in money through a pyramid scheme organized by Bernard Madoff. As a result, the fraudster was sentenced to 150 years in prison. In 2022, amid the destruction of the Terra ecosystem, investors, according to Fintwit, also lost about $60 million. Instead of punishing Do Kwon, he simply created another similar project.

LUNA 2: Beware of big dump

The reanimation and restart of the Terraform Labs ecosystem did not go as planned, and soon the LUNA walkers may face a new problem.

The developers of Terra are trying to set up a restarted ecosystem from scratch, but the upcoming LUNA Binance Crypto Exchange token deal may cause a coin dump and complicate life for those coin holders who intend to hoist it.

From scratch

After the collapse of the Terra ecosystem, its developers decided to clean up the legacy of the past and launch a completely new version of the network — Terra 2.0. On May 28, Terra ecosystem founder Do Kwon reported that the new blockchain had successfully launched from the zero block of genesis and was already producing blocks.

Also within the framework of the promised airdrop, users began to receive their new LUNA 2.0 coins, designed to replace old tokens UST and LUNA (Classic).

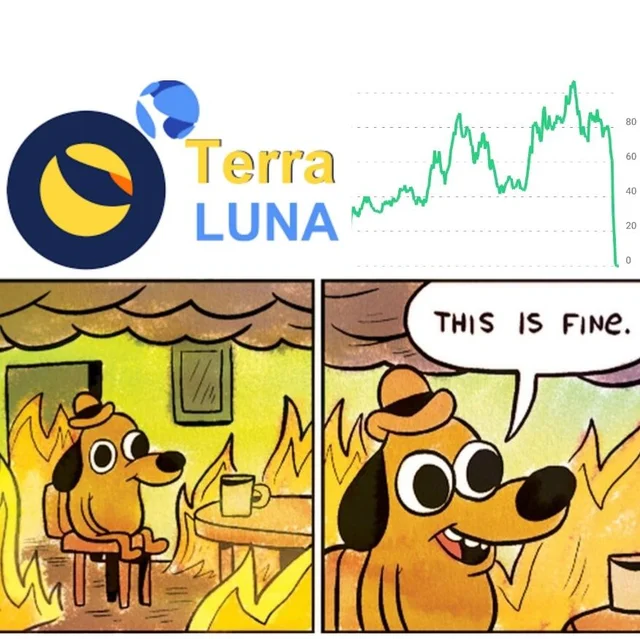

However, the project management still has few reasons for joy. As the BeInCrypto edition told us earlier, the LUNA 2 course collapsed after the airdrops began. If at the time of its debut, the value of the coin reached the highs on the approaches to the level of $19, then it fell to a minimum of $4.08, from which it recovered only marginally today, to the area of $6 at the time of writing.

The predominantly centralized exchanges have benefited from the increased sales of coyne, as they profit from trade commissions. In addition, one of the world’s largest trading platforms, Binance, may soon cause a new short-term wave of LUNA sales.

Binance was preparing a new strike?

The crypto exchange is preparing to hold its own airdrop for owners of the old LUNA and UST Classic. According to the official announcement made last weekend, the distribution of coins will begin on the morning of Tuesday, May 31. Colin Terra 2.0 itself will be listed by the exchange in the segment «Innovation Zone», which allows new tokens to be traded, which may be characterized by high risk and high volatility.

However, as the cryptoanalyst under the nickname «Terra Watcher» warns, this event can activate sales. He notes that the Binance address contains 15.7 million LUNA coins, which will be available to users on Tuesday morning. For comparison, the Kucoin Exchange, known for its high trading volumes, owns only 6.8 million coins.

According to the analyst, Binance users can dump tokens because the exchange offered a staking service in the Anchor protocol.

Many users of the exchange owned UST coins in Anchor. Many of them never had old LUNA coins and they don’t care about new LUNAs. Yes, they will dump».

The popular crypto-influencer Lark Davis has also confirmed similar sentiments among community members seeking to compensate for the losses they suffered due to the Terra crash:

«I’m not going to buy LUNA 2, but if I get anything from Binance, I’ll drop all the coins».

New LUNA tokens are able to compensate users for only a fraction of the losses they have suffered, and practice has shown that most participants in the crypto community immediately dispose of the coins received through airdrops. This situation has already spawned a flurry of jokes and memes on the Internet.

Sources:

Coinmarketcap

This isn’t financial or investment advice. Please do your own research