Court documents reveal Do Kwon dissolved Terraform Labs Korea days before LUNA crash

A revelatory discovery of legal documents could provide greater context for the catalyst of the infamous LUNA and UST price crash.

Initially reported by South Korean news outlet Digital Today, the information obtained from the country’s Supreme Court Registry Office highlight that Do Kwon successfully instigated the liquidation of two branches and an entire company.

Both the Busan headquarters and the Seoul offices were slated for dissolution during a general shareholders meeting on April 30, with their demise being actioned on May 4 and May 6, respectively.

The timing of these decisions has raised suspicions within the crypto community due to their potential correlation to the events comprising the financial obliteration of the Terra (LUNA) and UST stablecoin during the early hours of May 10.

Related: Why did Terra LUNA crash?

Polygon is calling on projects displaced and disgruntled by Terra’s collapse to join its ranks.

Polygon Studios CEO Ryan Wyatt shared via Twitter yesterday that Polygon—a sidechain built to compliment and help scale Ethereum—is launching a “multi-million dollar fund” called the Terra Developer Fund to help Terra projects move from Do Kwon’s now-infamous and failed blockchain onto Polygon.

https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NlbnNpdGl2ZV9tZWRpYV9pbnRlcnN0aXRpYWxfMTM5NjMiOnsiYnVja2V0IjoiaW50ZXJzdGl0aWFsIiwidmVyc2lvbiI6bnVsbH0sInRmd190d2VldF9yZXN1bHRfbWlncmF0aW9uXzEzOTc5Ijp7ImJ1Y2tldCI6InR3ZWV0X3Jlc3VsdCIsInZlcnNpb24iOm51bGx9fQ%3D%3D&frame=false&hideCard=false&hideThread=false&id=1529479315909332993&lang=en&origin=https%3A%2F%2Fdecrypt.co%2F101481%2Fterra-dies-forks-protocols-projects-move-polygon&sessionId=fcbf4e540f81ac3af4366722b1bc490f5ae5764e&siteScreenName=decryptmedia&theme=light&widgetsVersion=c8fe9736dd6fb%3A1649830956492&width=550px

Wyatt announced yesterday that the Terra NFT marketplace OnePlanet would be the first project to make the migration, and OnePlanet will help Polygon migrate more Terra projects. Specifically, Terra NFT projects can apply to join OnePlanet’s move to the new blockchain.

The news comes about a week and a half after Wyatt shared that Polygon was watching the Terra collapse and is “working closely with a variety of Terra projects to help them migrate over swiftly.”

While many Terra projects may be abandoning ship instead of sailing along with Kwon toward the upcoming Terra fork, the new Terra chain is making moves of its own. Kwon today shared news of the new Soil Protocol, which will facilitate NFT project deployment on the upcoming Terra 2.0 blockchain.

Terra 2.0 Genesis Imminent, So Who Gets a LUNA Airdrop?

Ongoing efforts behind the scenes are still progressing in the hope to revive the beleaguered Terra network and the second iteration of the blockchain is launching on mainnet this week.

The Terra proposal 1623 to revive the collapsed ecosystem by forking the blockchain and starting again with new tokenomics has garnered a lot of steam and support, especially from those who suffered heavy losses in the downfall of UST and LUNA.

Late last week, three amendments were made to the proposal which affect those who held the tokens before and after the “attack.” The official Terra Twitter channel also revealed that there will be no hard fork, but Terra 2 will be a brand new genesis blockchain.

On May 25, Terra validator ‘Orbital Command’ tweeted a lengthy post breaking down the details for the Terra 2 network, announcing that the new chain will go live on Friday, May 27.

https://platform.twitter.com/embed/Tweet.html?creatorScreenName=Crypt0nuts&dnt=true&embedId=twitter-widget-0&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NlbnNpdGl2ZV9tZWRpYV9pbnRlcnN0aXRpYWxfMTM5NjMiOnsiYnVja2V0IjoiaW50ZXJzdGl0aWFsIiwidmVyc2lvbiI6bnVsbH0sInRmd190d2VldF9yZXN1bHRfbWlncmF0aW9uXzEzOTc5Ijp7ImJ1Y2tldCI6InR3ZWV0X3Jlc3VsdCIsInZlcnNpb24iOm51bGx9fQ%3D%3D&frame=false&hideCard=false&hideThread=false&id=1529175192928411650&lang=en&origin=https%3A%2F%2Fbeincrypto.com%2Fterra-2-0-genesis-imminent-who-luna-airdrop%2F&sessionId=60447f208da62ce681ce37eb77e14b0f94a23cff&siteScreenName=beincrypto&theme=light&widgetsVersion=c8fe9736dd6fb%3A1649830956492&width=500px

Who gets what?

According to the validator, the Terra 2 native asset will be called LUNA, the old token will be LUNA Classic, and four groups will be eligible for airdrops of the new token.

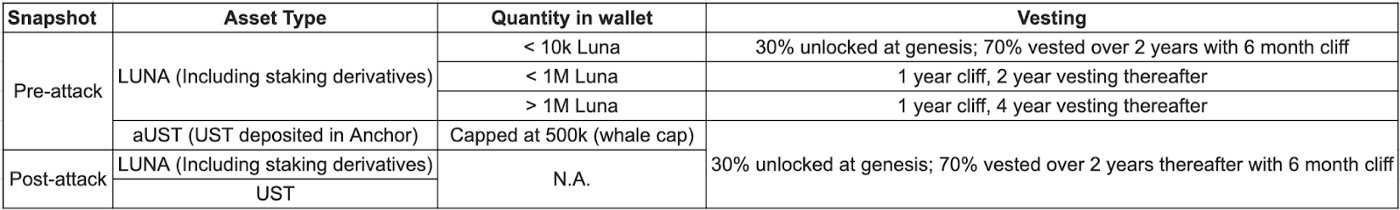

These are investors that held both LUNA and UST before the “attack” and ones that bought into the two tokens after the ecosystem began to fall. A pre-collapse snapshot has been taken on May 7 while a post-attack snapshot will occur on May 27.

Pre-attack LUNA holders will get an airdrop very close to 1:1 while those that bought the token after the collapse will get just 1:0.000015 (LUNA is currently trading at $0.00016).

UST holders get an even worse deal with those holding the stablecoin before it dumped from its peg getting just 1:0.033 and those buying in after getting 1:0.013 (UST is currently at $0.067).

Someone holding 1,000 UST on May 27, for example, will get airdropped 13 new LUNA tokens and someone holding old LUNA on May 27 will get just 0.15 of the new LUNA token per ten thousand LUNA’s they hold. Only about a third of the full airdrop will happen on Friday:

“Regardless of your category, you will get 30% of your airdrop at genesis (May 27), and the rest vested linearly over 2 years with a 6 month cliff.”

Additionally, the airdrop will occur in a “bonded state,” meaning that there is a 21-day unbonding period before transfers are available. It was this unbonding delay that caused thousands of investors and stakers to lose millions of dollars when the system collapsed.

Exchanges show initial support to Terra revival by listing new LUNA token

HitBTC plans to list Terra’s brand new token LUNA on May 27 as the suspended Terra Classic blockchain is expected to revive as Terra 2.0.

Crypto trading platforms show initial signs of support for the revival of the collapsed Terra network by listing Terra’s brand new token, also named LUNA.

The HitBTC exchange took to Twitter on Wednesday to announce that Terra’s new chain token Luna will be available on its platform on May 27.

The news comes amid Terraform Labs preparing to relaunch its protocol on Friday and replace the old chain, referred to as Terra Classic, with the new chain, called Terra or Terra 2.0. The new chain will not be a fork as it will be created from the genesis block and will not share a history with Terra Classic, Terraform Labs said on Monday.

The new Terra’s token will be named LU, replacing the old token referred to as Luna Classic (LUNC).

https://platform.twitter.com/embed/Tweet.html?creatorScreenName=cointelegraph&dnt=false&embedId=twitter-widget-1&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NlbnNpdGl2ZV9tZWRpYV9pbnRlcnN0aXRpYWxfMTM5NjMiOnsiYnVja2V0IjoiaW50ZXJzdGl0aWFsIiwidmVyc2lvbiI6bnVsbH0sInRmd190d2VldF9yZXN1bHRfbWlncmF0aW9uXzEzOTc5Ijp7ImJ1Y2tldCI6InR3ZWV0X3Jlc3VsdCIsInZlcnNpb24iOm51bGx9fQ%3D%3D&frame=false&hideCard=false&hideThread=false&id=1529359482056228864&lang=en&origin=https%3A%2F%2Fcointelegraph.com%2Fnews%2Fexchanges-show-initial-support-to-terra-revival-by-listing-new-luna-token&sessionId=9dc3c8d4bce786d0e440c4749c0d4763d777a6fd&siteScreenName=cointelegraph&theme=light&widgetsVersion=c8fe9736dd6fb%3A1649830956492&width=550px

HitBTC is apparently not the only crypto exchange intending to cooperate with Terraform Labs in the aftermath of UST and LUNA’s collapse. Following Terra’s successful rebirth vote, Binance crypto exchange announced that it will be «working closely with the Terra team on the recovery plan» to help impacted users on Binance.

Coinbase recently announced that it would delist the Wrapped Luna (WLUNA) token, an Ethereum token representing LUNA, on Friday. Coinbase Cloud, Coinbase’s infrastructure arm, announced on Friday, May 20 the suspension of support for Terra and all potential Terra chains in the near future.

On Wednesday, Terraform Labs CEO denied reports that he has been in touch with major South Korean crypto exchanges, asking them to list the new Luna token.

‘Terra 2.0 revival plan’ via airdrops, listing, buyback and burning

MEXC Global has pledged to carry out a month-long buyback-and-burn to reduce the circulating supply of the old Terra markets.

The fall of Terra shook the entire crypto market. However, the project has no plans to stay down, having secured backing from crypto exchanges to help it rebuild.

In an announcement on Thursday, Terra provided details on an upcoming airdrop of the new native token for its new blockchain dubbed Terra 2.0. The distribution of tokens will proceed on Friday, and holders of Terra Luna Classic (LUNC), TerraUSD Classic (USTC) and Anchor Protocol UST (aUST) who are eligible will receive new tokens

Crypto exchanges Binance and FTX noted that they are working closely with the Terra team regarding the upcoming airdrop. Binance stated that it aims to help affected users on the platform by helping Terra with the recovery plan.

FTX announced that it will support the airdrop and temporarily halt LUNA and UST markets during the migration. The Terra team said that in addition to Binance and FTX, it’s also working closely with more partner exchanges that will support the airdrop.

Apart from the airdrop, many crypto exchanges, like KuCoin, also expressed support for Terra 2.0 by supporting the migration, listing and trading of the new Terra tokens on their platforms.

However, not all exchanges are eager to list the new tokens. In a statement, a spokesperson from crypto exchange BitMEX told Cointelegraph that there are currently no plans to list the new Terra tokens. They explained:

“We list tokens for spot trading based on numerous factors, including that we have a custody solution for that particular token. As such, we have no plans at this stage to list LUNA for spot.”

As for derivatives contracts, the spokesperson said that the exchange needs to ensure there is a “reliable reference index” before it can consider contracts on the new LUNA token.

Meanwhile, not everyone is ready to fully move on to the new chain. Despite Terra founder Do Kwon’s position against burning LUNA’s circulating supply, users of the crypto trading platform MEXC Global voted to initiate buybacks and burning in Terra’s secondary market. Using the trading fees collected from the new LUNA/USDT spot trading pair within its platform, MEXC committed to a month-long buyback-and-burn process.

How the LUNA 2.0 airdrop will be distributed on May 27

Information, including examples, has been released regarding the LUNA 2.0 airdrop scheduled to happened on May 27, 2022

Terraform Labs has released information regarding the LUNA 2.0 airdrop scheduled for May 27, 2022. UPDATE May 27 08:50 GMT: Airdrop time now pushed to May 28th, 2022 at 06:00:00 GMT

The current LUNA token will be renamed LUNC, while the new LUNA 2.0 token will assume the ticker LUNA. Holders of LUNC (Luna Classic), USTC (UST Classic), and aUST (staked UST) will be airdropped LUNA tokens from the new chain.

LUNA Airdrop

The testnet is currently live for LUNA 2.0, and the mainnet will be activated on May 28. When the mainnet goes live, the airdrop will begin. According to a Terraform Labs verified Medium post, you will be eligible for the airdrop if:

At the Pre-Attack snapshot, hold:

- LUNA (including staking derivatives)

- Less than 500k aUST (UST deposited in Anchor)

And/or at the Post-Attack snapshot, hold:

- LUNA (including staking derivatives)

- UST

The snapshot timings used in the above criteria are shown below:

When will the airdrop happen?

The genesis block of LUNA 2.0 will occur on May 27, 2022, at which time 30% of the LUNA airdrop will be issued, with the remaining 70% to be issued over two years with a six-month cliff. The cliff means users will start to receive the rest of their airdrop after 6-months at around 3.9% per month.

“At Genesis, 30% of the LUNA airdrop will be immediately available to Pre-Attack users with wallets that had less than 10k LUNA (including staking derivatives) or deposited UST in Anchor, and Post-Attack users with any quantity of LUNA (including staking derivatives), UST, or both.”

All airdropped tokens will be automatically staked to “preserve network security.” Non-vested LUNA can be removed at any point. However, vested LUNA will be staked according to the above schedule. However, it does appear that investors will still be able to claim their rewards at any point.

“Users will earn staking rewards on their vesting LUNA starting from the point at which it is staked, and can claim these rewards at any point.”

Regarding vested LUNA, “if a user would like liquid LUNA as soon as their cliff hits, they’ll need to undelegate their staked, vested LUNA at least 21 days before the first day of their cliff.” However, information in Table 4 of the Medium posts suggests that bridged LUNA will be “distributed at a later date.”

LUNA tokens that will not be included in LUNA 2.0

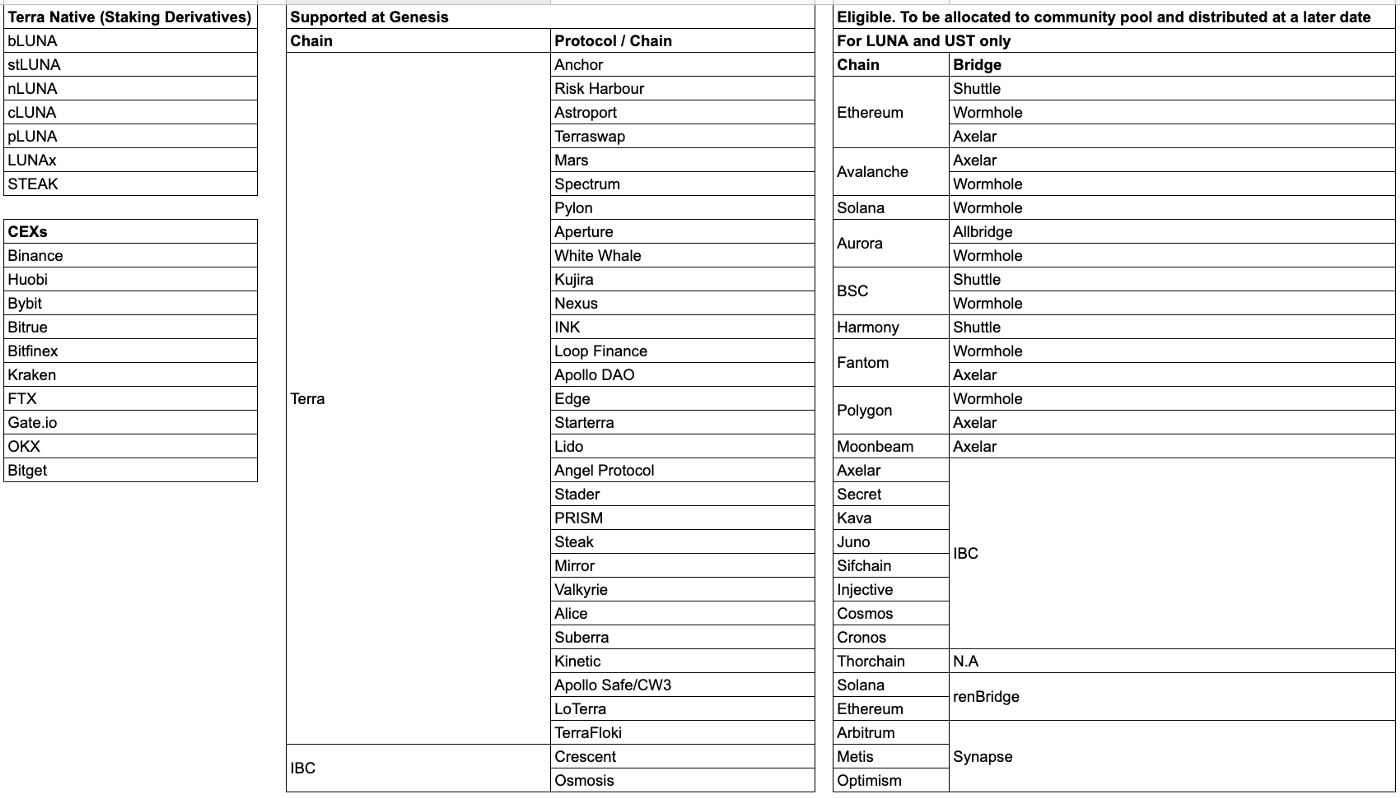

Any LUNA currently held in the bridge contract will be set aside “as part of the community pool for distribution after the chain launches.”

Therefore, it may be prudent for investors who hold LUNA bridged off of Terra, such as Wormhole or wLUNA, may wish to convert into LUNA tokens before the snapshot.

The Medium post outlines the following scenarios where the airdrop will not be available.

UST or LUNA bridged off of Terra

- Users with bridged UST or LUNA who would like to be included in the Post-Attack snapshot need to bridge back to Terra before the snapshot is taken.

UST or LUNA on Terra protocols that cannot be easily identified

- All protocols listed on DeFi Llama here will be covered, in addition to a few others that are known.

UST or LUNA on CW3 multi-sig contracts

- Most UST and LUNA in CW3 multi-sig contracts will be accounted for, but there could be edge cases that may not be included.

Supported tokens, exchanges, and chains

The below table gives a comprehensive breakdown of what will be included in the LUNA 2.0 airdrop. Investors who held LUNA before the snapshot or hold through the May 26 snapshot will receive airdrops on Binance, Huobi, Bybit, Bitrue, Bitfinex, Kraken, FTX, Gate.io, OKX, and Bitget.

Other exchanges may also support the airdrop but are not currently confirmed by Terraform Labs. For example, Swissborg recently notified its users that they are working on distributing the LUNA 2.0 airdrop to users even though it does not list LUNC.

Swissborg lists UST as a token and will likely receive a LUNA 2.0 airdrop on behalf of its users. The technical complexity of solving this issue is one facing many exchanges around the world.

UPDATE May 27 08:50 GMT: Revised airdrop and mainnet timings to meet new release times from Terraform Labs

Too late to prevent crypto winter

«Several projects have already pledged support to work with Terra 2, and these include Nebula, Sigma, Prism, Astroport, Phoenix, Nexus, Spectrum, Anchor, One Planet, Random Earth, and Coinhall.

However, the grand Terra revival plans have come too little, too late for the overall crypto market as sentiment is firmly in the bearish territory now. Markets have dumped 43% since the beginning of the year, equating to a whopping $1 trillion leaving the space as another prolonged bear cycle begins.» — Decrypt team says.

This is just a news, not a financial or investing advice. DYOR

Sources:

https://cointelegraph.com/

https://decrypt.co/

https://beincrypto.com/

https://cryptoslate.com/