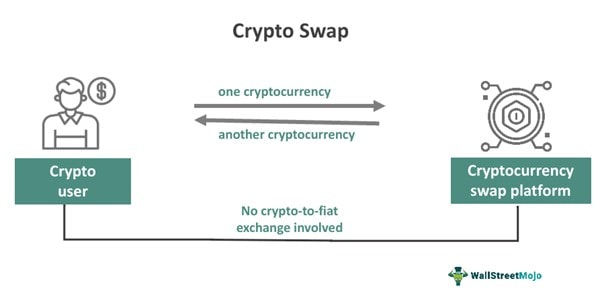

Cryptocurrency swap is a form of decentralized exchange that allows users to trade cryptocurrencies directly with each other without intermediaries. This process is carried out based on liquidity pools and smart contracts, which is a key difference from traditional centralized exchanges.

Unlike centralized platforms, where trading requires creating an account, passing verification and is often associated with various withdrawal restrictions, swap platforms offer a more flexible and accessible approach. These platforms do not require registration or verification, which ensures a high level of privacy and anonymity of transactions. Users simply connect their crypto wallets to the platform and can instantly exchange tokens. All transactions are carried out through smart contracts that are automatically executed on the blockchain, eliminating the need to trust a third party.

Such platforms are usually governed by the community through governance mechanisms such as token holder voting. This helps to create a democratic and transparent trading environment where each participant has the opportunity to influence the development of the platform.

Examples of popular swap platforms include Uniswap, PancakeSwap, and 1inch. Uniswap is one of the first and most well-known decentralized platforms, using the Ethereum blockchain to enable the exchange of ERC-20 tokens. PancakeSwap runs on Binance Smart Chain smart contracts and offers similar services, but with lower transaction fees. 1inch combines several DEXs (decentralized exchanges) into a single platform, offering users optimal swap paths to minimize transaction costs.

The use of swap platforms in crypto trading continues to gain popularity due to their ability to provide fast, secure and transparent exchange transactions, satisfying traders’ needs for privacy and control over their own funds.

Why use cryptocurrency swap

Using swap cryptocurrencies offers many benefits, from decentralization to access to the latest assets. Firstly, the key aspect is the decentralization of the exchange process, which means there is no control or interference from third parties. This not only increases the security of transactions, but also provides users with privacy, as transactions are processed directly between the parties without the need to disclose personal information.

Exchanging cryptocurrencies through swap platforms such as Uniswap or PancakeSwap is quick and easy, often in just a few clicks, making the process convenient and accessible even for novice users. In addition, fees on such platforms are significantly lower than on traditional centralized exchanges, making them attractive to all types of traders.

Swap platforms also provide access to new and emerging crypto assets, including DeFi tokens and non-fungible tokens ( NFTs ), which often appear on decentralized platforms much earlier than on standard exchanges. This provides traders with unique investment opportunities in the latest trends and innovations in the crypto world.

Participation in liquid pools and the possibility of receiving passive income are another significant advantage of using swap cryptocurrencies. Users can provide their assets for liquidity on platforms and receive commissions from transactions carried out in this pool in return. This offer allows you to not only hold cryptocurrency, but also earn money on it.

Users can also participate in Initial Farm Offerings (IFOs) on platforms like PancakeSwap, which provide early access to the initial offering of new tokens. Also popular is the ability to purchase NFTs on the same platforms, which is becoming an increasingly popular way to invest and collect digital art.

Overall, the use of swap cryptocurrencies provides a wide range of opportunities for traders and investors, making the crypto market more accessible, efficient and profitable for all participants.

How does cryptocurrency swap work

Using decentralized cryptocurrency exchange platforms allows users to quickly and securely conduct transactions directly through their cryptocurrency wallets. Here is a step-by-step guide on how to conduct a cryptocurrency exchange using Uniswap as an example:

1. Connect a wallet : To get started, you’ll need to connect your cryptocurrency wallet to the Uniswap platform. Popular options include MetaMask, WalletConnect, and other wallets that support Ethereum. On the Uniswap homepage, select the “Connect Wallet” option and follow the instructions to connect. This may require scanning a QR code or logging in via a browser extension.

2. Select the cryptocurrency to exchange : After connecting the wallet, select the cryptocurrency you want to exchange. For example, if you want to exchange Ethereum, select ETH from the drop-down list on the platform.

3. Select the cryptocurrency to receive : Next, select the cryptocurrency you want to receive as a result of the exchange. For example, if you want to receive USDT, select USDT from the second drop-down list.

4. Specify the amount to exchange : Enter the amount of cryptocurrency you want to exchange. The platform will automatically calculate how much you will receive in the selected currency to receive based on the current exchange rate.

5. Check the exchange rate and slippage : Before confirming a transaction, pay attention to the exchange rate and possible slippage, which indicates how much the rate may change for the worse during the execution of your order. This is important to avoid unexpected losses due to high market volatility.

6. Confirm the transaction : Once you have checked and are satisfied with the information received, click the button to confirm the exchange. Your wallet will ask for confirmation to complete the transaction. Confirm the transaction in your wallet by following its instructions.

Once the transaction is confirmed, it will be sent to the Ethereum blockchain and you must wait for it to be processed. The processing time may vary depending on the network load. Once the processing is complete, you will receive the desired cryptocurrency in your wallet and the transaction will be completed.

Key concepts

Cryptocurrency swap is the process of exchanging one cryptocurrency for another via decentralized platforms, which is based on key concepts such as liquid pools, pool tokens, exchange rate, and slippage. Let’s look at each of these concepts in more detail.

Liquid pools are cryptocurrency reserves that are collected on decentralized platforms such as Uniswap or SushiSwap. These reserves are created and maintained by users who contribute their assets to the pool to provide the liquidity needed to exchange cryptocurrencies between different users. Through these pools, traders can instantly buy or sell cryptocurrencies without having to find a direct counterparty for each trade.

Pool tokens are special tokens that users receive in exchange for contributing their assets to a liquid pool. These tokens represent an ownership stake in the pool and can be used to receive a share of the fees generated by the platform from trades, as well as to participate in the governance of the platform. Pool tokens can be exchanged back for the contributed assets at any time, often with additional rewards for providing liquidity.

An exchange rate is the max price at which one cryptocurrency is exchanged for another. This rate is usually determined automatically based on the supply and demand ratio in the liquid pool. Exchange rates on decentralized platforms are constantly updated in real time and may differ from rates on traditional exchanges due to differences in liquidity and trading activity.

Slippage is the difference between the expected price of a trade when an order is placed and the actual price at which the order is executed. Slippage most often occurs during periods of high volatility or when a trade order is too large relative to the available liquidity in the pool. Although slippage can be either positive or negative, traders seek to minimize its impact by setting maximum slippage parameters when placing orders.

Understanding these key aspects of cryptocurrency swaps helps traders effectively manage their investments and optimize trading strategies on decentralized platforms, taking advantage of the benefits they provide.

Review of 3 popular swap crypto platforms

1. Uniswap

Founded in 2018 by Hayden Adams, Uniswap is a pioneering platform in the decentralized finance (DeFi) space. The platform was created to simplify the process of exchanging cryptocurrencies without the need for a centralized intermediary, allowing users to trade directly from their wallets.

Key features of Uniswap include its status as one of the oldest and most popular decentralized swap exchanges. The platform is known for its simple and user-friendly interface, making it accessible even to cryptocurrency newbies. Uniswap supports a wide range of cryptocurrency pairs, providing users with a variety of trading options, and is compatible with various types of wallets such as MetaMask, WalletConnect, and others, making it a versatile platform for different users. With an active developer community, Uniswap is constantly updated and improved to provide better features and functions to its users.

An important step in the platform’s development was the introduction of Uniswap v3 after Uniswap v2, which brought significant improvements. Uniswap v3 offered improved energy efficiency, which is especially important in the context of general concerns about the impact of technology on the environment. In addition, the new version of the platform introduced more flexible settings for liquidity pools, allowing users to fine-tune their investments and manage risks. One of the most significant innovations was the concept of concentrated liquidity, which allows for reduced slippage, increasing trading efficiency and reducing potential losses for traders.

Advantages of Uniswap

- Decentralization : Uniswap is completely decentralized, meaning there is no centralized control, reducing the risks associated with hacking attacks on centralized servers and abuse by managers.

- Automation via smart contracts : All trades on Uniswap are done via automated smart contracts, eliminating the need for intermediaries and reducing fees.

- Liquidity : Uniswap uses a unique liquidity model where users can deposit their assets into liquid pools and earn trading fees. This ensures high liquidity on the platform.

- Support for a wide range of tokens : The platform supports a wide range of ERC-20 tokens, giving users a wide range of choices for trading.

- Ease of Use : Uniswap’s interface is intuitive, making it accessible even for cryptocurrency novices.

Disadvantages of Uniswap

High risk of slippage : During periods of high volatility, users may experience high slippage due to price changes between the time a transaction is made and its execution.

Inconsistent transaction fees : Due to gas volatility on the Ethereum network on which Uniswap operates, transaction fees can vary significantly, sometimes making small trades impractical.

Limited risk management : Uniswap lacks traditional risk management tools such as stop losses and margin trading, which may make it less attractive to more experienced traders.

Impermanent Loss : Liquidity providers may experience impermanent loss due to price fluctuations in the pool, which may result in losses exceeding the fees earned.

Target Audience : The platform may be less attractive to institutional investors, who typically prefer more traditional, regulated and centralized exchanges.

Overall, Uniswap offers a unique and accessible way to trade cryptocurrencies, but using it requires understanding the risks involved and the specifics of working on decentralized platforms.

2. PancakeSwap

PancakeSwap was launched in 2020 by a team of developers who wanted to create a user-friendly and functional decentralized exchange (DEX) based on the Binance Smart Chain (BSC) blockchain. The project has quickly established itself as one of the leading cryptocurrency exchange platforms, using the BNB token as the main currency for trading and fees. PancakeSwap fits into the Binance Smart Chain ecosystem as a key element, offering users high transaction speeds and low fees thanks to the efficiency and optimized structure of BSC.

One of PancakeSwap’s unique features is its Initial Farm Offerings (IFOs) — special offers to launch new crypto projects. IFOs allow users to purchase new tokens before they are officially listed on the market, often on favorable terms. This gives investors access to the early stages of promising projects and contributes to the growth and development of the entire BSC ecosystem.

PancakeSwap has also developed its own NFT marketplace where users can buy and sell non-fungible tokens. This feature attracts a wide range of collectors and creatives looking to explore the possibilities of NFTs in art, music, and other fields.

Staking pools are another significant benefit of PancakeSwap, offering users the opportunity to earn passive income. Users can “freeze” their tokens in special staking pools to receive rewards in the form of additional tokens for providing liquidity to the platform. This not only promotes long-term capital retention on the platform, but also increases the overall liquidity and stability of the project.

Benefits of PancakeSwap

- Low transaction fees : One of the significant advantages of PancakeSwap is its low transaction costs thanks to the use of Binance Smart Chain , making the platform especially attractive for frequent and high-volume trading.

- High transaction speed : BSC provides high performance and fast transaction processing time, which is critical for operating a decentralized exchange.

- Variety of earning tools : PancakeSwap offers users a variety of ways to earn money, including liquidity farming, staking, and participating in Initial Farm Offerings (IFO).

- Access to a wide range of cryptocurrencies : The platform offers numerous cryptocurrency pairs, giving users a wide range of choices for trading and investing.

- Integration of NFTs and other innovative projects : PancakeSwap is actively embracing new trends such as NFT trading, giving users access to new and exciting opportunities.

Disadvantages of PancakeSwap

- Limited Regulation : Like most decentralized exchanges, PancakeSwap is not heavily regulated, which may raise concerns among investors about the security and transparency of its operations.

- Risk of Impermanent Loss : Participation in liquid pools involves a risk of impermanent loss, especially in highly volatile market conditions.

- Difficulty for Newbies : Despite the intuitive interface, the extensive functionality may be difficult to understand for new users without prior experience with cryptocurrencies or decentralized finance.

- Dependency on Binance Smart Chain : Since PancakeSwap relies on the BSC infrastructure, any issues affecting that network could impact the platform.

3.1 inch

1inch was launched in 2019 by a team of cryptocurrency enthusiasts and has become known for its innovative approach to decentralized trading.

The main idea of the platform is to function as a liquidity aggregator that scans various decentralized exchanges (DEX) for the best exchange rates, giving users the opportunity to make exchanges at the most favorable conditions. This solution allows traders to save coins on fees and get the best possible prices for cryptocurrencies without having to visit multiple platforms.

Among the functional capabilities of 1inch, several key aspects stand out:

- Instant Swap : This feature allows users to instantly exchange cryptocurrencies at the best rates found by the aggregator. This is especially useful in highly volatile markets, where quick access to the best rate can significantly improve trading efficiency.

- Limit Order : 1inch provides the ability to place limit orders, giving users control over the buy or sell price. This means that the order will only be executed when the market price reaches the specified level, providing greater strategic flexibility in portfolio management.

- Gas Optimization : One of the problems with Ethereum that DEX users often experience is the high cost of transactions, or “gas.” 1inch implements gas optimization algorithms that minimize the amount of gas needed to complete transactions, thereby reducing overall transaction costs.

1inch aims to make the process of trading on decentralized platforms more accessible and profitable, offering advanced solutions that take into account the needs of both experienced traders and the requirements of cryptocurrency newcomers. The combination of high functionality, ease of use, and strategic opportunities makes 1inch an important tool in the arsenal of any crypto trader.

Advantages of 1inch

- Liquidity Aggregation : 1inch scans multiple DEXs like Uniswap, SushiSwap, and more to offer users the best available exchange rates. This allows traders to save on fees and improve initial trade conditions.

- Optimizing transaction costs : The platform automatically calculates the most efficient paths for transactions, which helps reduce gas costs on the Ethereum network, especially important during periods of high fees.

- Flexibility of trading strategies : Users can place limit orders and use other advanced trading strategies, making 1inch attractive to more experienced traders.

- Decentralization and Security : Since 1inch does not store user funds, it offers a high level of security and minimizes the risks associated with hacker attacks on centralized exchanges.

Disadvantages of 1inch

- Interface Complexity : For beginners, the 1inch interface may seem complicated, especially when using advanced features such as limit orders or gas optimization.

- Dependency on Ethereum network state : Since many of the DEXs that 1inch aggregates run on Ethereum, high gas fees during busy periods can remain an issue despite efforts to optimize them.

- Risk of Impermanent Loss : As with other liquidity platforms, 1inch users may face an impermanent loss due to sharp market movements.

- Limited control over transactions and : While aggregation allows for better rates, users may not always have control over the outcome of each transaction in real time, which can lead to slippage, especially during volatile periods.

Overall, 1inch provides a powerful tool for optimizing trading on decentralized exchanges, combining advanced features with transaction savings. However, its effectiveness may depend on the user’s experience and the current state of the blockchain networks it operates on.

Comparison of Uniswap, PancakeSwap and 1inch by key parameters

Comparing Uniswap, PancakeSwap, and 1inch on key parameters such as functionality, fees, liquidity, and audience will help you understand the main differences and similarities between these popular decentralized exchanges (DEX).

Functionality

- Uniswap : Provides token swaps, liquid pools, staking. Supports ERC-20 tokens running on the Ethereum blockchain.

- PancakeSwap : In addition to standard exchange and liquidity pool features, it includes farming, lotteries, an NFT marketplace, and Initial Farm Offerings (IFO). It runs on Binance Smart Chain and uses the BEP-20 token.

- 1inch : Liquidity aggregator that connects multiple DEXs to provide the best rates. Supports complex trading strategies such as limit orders and gas optimization for Ethereum.

Commissions

- Uniswap : Trading fees are 0.3% of each trade, which is split between liquidity providers.

- PancakeSwap : Fees are lower than Uniswap due to lower transaction costs on Binance Smart Chain, at 0.2% per trade.

- 1inch : Does not charge additional fees, but users pay fees to the DEX the trade goes through; 1inch aims to minimize these fees through aggregation.

Liquidity

- Uniswap : One of the highest liquidity among DEXs due to its large number of users and long history.

- PancakeSwap : High liquidity, especially for BEP-20 token pairs; competes heavily with Uniswap in trading volumes.

- 1inch : Liquidity depends on connected DEXs; could theoretically offer the best available liquidity by combining sources.

Audience

- Uniswap : Attracts primarily Ethereum users interested in trading ERC-20 tokens and participating in the DeFi ecosystem.

- PancakeSwap : Attracts users looking for fast and cheap transactions, as well as innovative features like IFOs and NFTs.

- 1inch : Targets more experienced users and traders looking for better prices through aggregation and fee optimization, especially those trading across multiple DEXs.

This comparison shows that each of these DEXs has its own unique benefits and may be better suited for different types of users depending on their cryptocurrency trading needs and preferences.

Recommendations for choosing a swap platform

When choosing a decentralized swap platform for exchanging cryptocurrencies, it is important to consider both your level of experience and your specific trading needs. Here are some guidelines for choosing the right platform based on different criteria:

Uniswap and PancakeSwap — Products for Beginner Traders

Uniswap and PancakeSwap are great options for beginners due to their ease of use and wide recognition in the community. These platforms offer intuitive interfaces that simplify the process of exchanging cryptocurrencies, making them accessible even to those who are just starting out in the world of cryptocurrency.

Uniswap is attractive due to its large user base and high liquidity, which provides good conditions for exchanging most popular ERC-20 tokens.

PancakeSwap , which runs on Binance Smart Chain, offers similar features with the addition of some unique capabilities such as NFT farming and trading, as well as the benefit of low fees and fast transactions, making it attractive to those looking for more cost-effective options.

1inch is recommended for advanced users

1inch is recommended for more advanced users who want to maximize their profits and reduce their fees. This platform functions as a liquidity aggregator, scanning multiple DEXs to find the best rates and minimize slippage.

1inch offers advanced features such as limit orders and gas optimization, which are especially valuable for those who trade large and frequently and want to have control over the exact parameters of their trades.

This platform is also suitable for traders interested in using different blockchains, as 1inch supports trading on multiple networks, thus providing greater flexibility and access to a wide range of assets.

Choosing the right swap platform depends on your level of knowledge, your trading preferences, and technical requirements. Beginner traders may find it easier to start with Uniswap or PancakeSwap to learn the basics without complex settings, while experienced users may appreciate the advanced features and flexibility that 1inch offers.

Автор Alex Smith

Имеет профессиональную подготовку в области микроэлектроники и аппаратного программирования, а также более 30-ти лет опыта работы с системами обработки и передачи данных, включая оборудование для майнинга криптовалют. Готовя материал для читателей блога BuyCrypt успешно применяет свой обширный технический бэкграунд для максимально точной передачи смысла материалов с используемых источников.