Cryptocurrencies continue to have a significant impact on the global economy, introducing new elements to the financial landscape and changing the way we invest, trade, and store wealth. These digital assets, which use cryptography to secure transactions and control the creation of new units, stand out for their decentralization, which has attracted the attention of both individual and institutional investors.

The criteria for selecting cryptocurrencies for inclusion in the top 10 list are usually based on several key parameters. The first and most important criterion is market capitalization, which reflects the total market value of all cryptocurrency units in circulation. Other important criteria include the liquidity of the asset, the breadth of its use in real economic transactions, the level of trading security provided by blockchain technology , and the innovativeness of the technological solution underlying the cryptocurrency. All these factors together help to form an objective view of the significance and potential of cryptocurrencies in the international market.

Thus, the top 10 cryptocurrencies do not just show the most valuable assets, but also highlight those cryptocurrencies that have the potential to have the greatest impact on financial markets, attracting the attention of investors and experts around the world.

What is Cryptocurrency Market Cap

This is the total value of all issued coins at a given point in time. To determine its market capitalization, the number of all generated coins (emission) and the value of the cryptocurrency on the market are taken into account. It can be determined by multiplying the price by the number of issued coins. The capitalization of the entire crypto market is the supply volume of all coins.

In 2021, the total capitalization of cryptocurrencies exceeded $3 trillion, after which it decreased slightly. At the beginning of 2024, it is about $2 trillion.

The main part – from 40% to 60% of capitalization – is occupied by Bitcoin ( BTC ). The total number of monitored coins has exceeded 12,700.

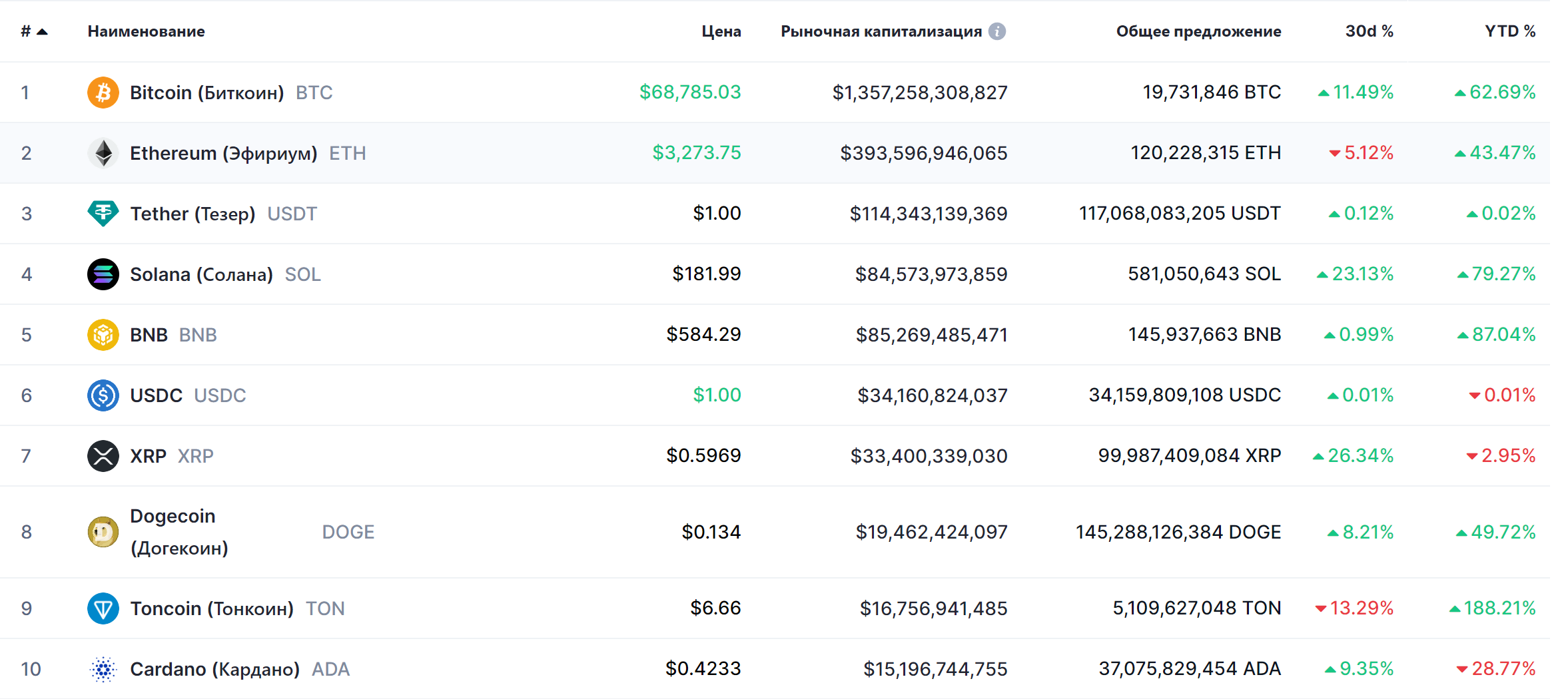

List of 10 Best Cryptocurrencies to Add to Your Portfolio in 2024

Next, we will consider the rating of cryptocurrencies by capitalization, namely the digital assets occupying the first ten places. All data is taken from the cryptocurrency aggregator CoinMarketCap at the time of writing.

The review of the list should begin with the most expensive cryptocurrency today, Bitcoin (BTC). It is natural, because it was the first cryptocurrency and laid the foundation for the development of an entire industry.

1. Bitcoin (BTC)

- Market cap: $1.34 trillion.

- Price: $68.08

- Price change over the last month: +11%

- Price change over the year: +61%

- Total supply: 19,731,756 BTC

Bitcoin (BTC) is the world’s first and most well-known cryptocurrency, created in 2009 by an unknown person or group of people under the pseudonym Satoshi Nakamoto. This digital currency is a decentralized system that allows users to make secure transactions directly, without intermediaries such as banks or governments. Unique features of Bitcoin include its decentralized nature, a limited supply of 21 million coins, making its price similar to digital gold, and a high level of security provided by blockchain technology.

Bitcoin is often viewed as an attractive asset for both long-term and short-term investment. Its history shows the potential for significant growth in value, especially during periods of financial instability when investors seek alternative ways to preserve capital. However, it is important to remember that investing in Bitcoin carries a high level of risk, as the price of the cryptocurrency can be extremely volatile.

For long-term investors who see Bitcoin as a way to preserve value against inflation and the declining purchasing power of traditional currencies, BTC can serve as insurance against financial crises. Short-term investors, on the other hand, can use Bitcoin’s volatility to speculate and make quick profits, but should be prepared for the possibility of significant losses.

2. Ethereum (ETH)

- Market cap: $393.7 billion

- Price: $3.27

- Price change over the last month: -3.6%

- Price change over the year: +43.6%

- Total Supply: 120,228,315 ETH

Ethereum (ETH) , the second most popular cryptocurrency after Bitcoin, was introduced in 2015 by Vitalik Buterin. The project is designed as a platform for building decentralized applications (dApps) using smart contracts, automatically executed contractual agreements that function without any intermediary. The main unique features of Ethereum include the ability to create and run native decentralized applications on the blockchain, which opens up wide opportunities for innovation in various fields, from finance and insurance to gaming and digital identity.

Ethereum is considered one of the most promising cryptocurrencies for long-term investment, given its central role in the decentralized finance (DeFi) and non-fungible token ( NFT ) ecosystem. The platform continues to evolve, and with the transition to Ethereum 2.0, its functionality and efficiency are expected to further increase. However, like any investment in cryptocurrency, investing in ETH is associated with a high level of risk due to market volatility and various technical and regulatory factors.

Short-term investors may also find opportunities to profit from ETH price fluctuations, but this requires a deep understanding of the market and a willingness to accept potential losses. In any case, potential investors are advised to conduct careful data analysis and, if necessary, consult with financial experts before making significant investments in Ethereum.

3. Tether (USDT)

- Market cap: $114.3 billion

- Cost: $1.00

- Price change over the last month: +0.12%

- Price change over the year: +0.02%

- Total offer: 117,068,083,205 USD

Tether (USDT) was launched in 2014 and was one of the first stablecoins in the cryptocurrency world. This type of digital currency is pegged to traditional fiat currencies, in the case of USDT to the US dollar, providing price stability at a ratio of 1 USDT to 1 USD. Tether is used primarily for trading on cryptocurrency exchanges, giving traders the opportunity to avoid the volatility of cryptocurrencies without having to withdraw funds to fiat. The main advantages of Tether are its stability, high liquidity, and wide availability on many platforms.

Tether is not generally considered an investment vehicle in the traditional sense, as it is not intended to profit from changes in value. Rather, USDT is used as a store of value in the cryptocurrency markets and a tool for easily moving between different cryptocurrencies without having to convert to fiat money. However, despite its stability, investing in USDT comes with certain risks, including legal and regulatory issues that have affected Tether in the past.

4. Solana (SUN)

- Market cap: $86.4 billion

- Price: $185.9

- Price change over the last month: +33.4%

- Price change over the year: +83.1%

- Total offer: 581,051,098 SOL

Solana (SOL) was launched in 2020 and quickly established itself as one of the most innovative blockchain platforms. The project was founded by Anatoly Yakovenko, who developed a new blockchain architecture that allows for high transaction speeds thanks to a unique consensus algorithm called Proof of History (PoH). This technology allows for significantly faster transaction processing times, making Solana one of the fastest blockchain systems. Solana’s applications span a wide range, including decentralized finance (DeFi), decentralized applications (dApps), and digital assets such as NFTs.

Like any other cryptocurrency, investing in Solana involves a certain level of risk, especially due to the high volatility of cryptocurrency markets. However, due to its unique technological solutions and growing use as a platform for decentralized applications, Solana is an attractive long-term investment. Investors interested in innovative technologies and the potential of blockchain to support a new generation of internet applications may want to consider SOL as part of their investment portfolio.

5. Binance Coin (BNB)

- Market cap: $85.8 billion

- Price: $587.9

- Price change over the last month: +2.5%

- Price change over the year: +88.2%

- Total supply: 145,937,673 BNB

Binance Coin (BNB) was created in 2017 as part of the initial coin offering (ICO) of the cryptocurrency exchange Binance. BNB was initially released on the Ethereum blockchain astoken, but migrated to its own blockchain, Binance Chain, in 2019. BNB’s primary use is as a utility token on the Binance platform, where it provides users with discounts on trading fees, as well as being used in staking, payouts, and other Binance-focused projects, including Binance Smart Chain, a platform for building smart contracts and decentralized applications.

Binance Coin can be interesting for both long-term and short-term investors. For long-term investors, BNB offers growth potential through integration with the growing Binance ecosystem, which is constantly expanding to include new products and services. Short-term investors can take advantage of BNB’s price volatility for speculative trading.

6. USD Coin (USDC)

- Market cap: $34.1 billion

- Price: $0.99

- Price change over the last month: +0.01%

- Price change over the year: -0.02%

- Total supply: 34,149,337,685 USDC

USD Coin (USDC) is a stablecoin that was launched in September 2018. USDC was created jointly by Circle and Coinbase as part of the CENTRE consortium. The cryptocurrency is pegged 1:1 to the US dollar, which is backed by the availability of dollar reserves. The primary use of USDC is to provide stability and reduce volatility for traders and investors in the cryptocurrency markets, as well as serving as a medium of exchange and store of value.

USDC maintains full transparency, confirmed by regular audits from independent auditing companies, which confirms the availability of the required amount of dollar reserves. This guarantees its stability and makes it attractive for use in digital transactions where fast and secure currency exchange is required.

As a stablecoin, USDC is not intended for those looking for an investment with the potential for significant growth in value. However, it is a reliable tool for risk management, especially in cryptocurrency-focused portfolios. USDC is an ideal choice for long-term holdings to preserve value without the risk of cryptocurrency inflation volatility. Risks associated with USDC mainly lie in potential regulatory changes that could affect stablecoins in general.

7. Ripple (XRP)

- Market cap: $34.01 billion

- Price: $0.61

- Price change over the last month: +28%

- Price change over the year: -1.27%

- Total Supply: 99,987,409,084 XRP

Ripple , and its XRP token, were created in 2012 as part of an effort to create a more efficient and decentralized payment system. The project was developed by Ripple Labs, which aimed to improve global financial transactions by offering instant, reliable, and low-cost international transfers. XRP is used on the Ripple network as a bridge currency, allowing one currency to be converted to another quickly and efficiently, while minimizing the need for traditional currency exchange.

One of the key features of XRP is its ability to provide fast and cheap transactions. The transaction processing time on the Ripple network is usually a few seconds, and the transfer fees are negligible, making XRP an attractive choice for international transfers. In addition, Ripple has partnerships with many leading banks and financial institutions around the world, demonstrating its practical value in real business transactions.

XRP may be of interest to short-term investors looking to take advantage of market volatility to make a profit. However, long-term investors should be especially cautious given the ongoing legal challenges and uncertainty surrounding the cryptocurrency’s regulatory future. The risk level for investing in XRP is above average due to potential regulatory changes that could significantly impact the cryptocurrency’s availability and use in the future.

8. Dogecoin (DOGE)

- Market cap: $34 billion

- Price: $0.61

- Price change over the last month: +28%

- Price change over the year: -1.27%

- Total Supply: 99,987,409,084 XRP

Dogecoin (DOGE) was created in December 2013 by programmers Billy Markus and Jackson Palmer. Initially intended as a humorous alternative to more serious cryptocurrencies like Bitcoin, Dogecoin quickly gained popularity among the internet community due to its playful approach and Shiba Inu meme. Despite its humorous beginnings, DOGE is used for online tipping and charitable donations, as well as micropayments, due to its low transaction fees and fast payment processing.

Dogecoin stands out from other cryptocurrencies due to its accessibility and friendly community. It has one of the most active user bases, who often participate in various charity and social projects. In terms of technical features, DOGE offers fast transaction times and low transaction costs, making it a practical choice for small daily transactions.

Dogecoin may be attractive to short-term investors looking to capitalize on its volatility and media popularity. However, long-term investors should approach with caution given its speculative nature and lack of fundamental economic support that other major cryptocurrencies have. The level of risk in investing in DOGE is high due to its dependence on internet trends and potential exposure to regulatory influences.

9. Toncoin (TON)

- Market cap: $16.8 billion

- Price: $6.71

- Price change over the last month: -12.5%

- Price change over the year: +190.5%

- Total supply: 5,109,627,048 TON

Toncoin (TON) , originally known as Telegram Open Network , was developed by a team associated with the creators of the Telegram messenger. The project was launched in 2018 under the leadership of Pavel Durov, but after legal disputes with the US Securities and Exchange Commission (SEC), the official project was closed in 2020. Despite this, the developer community continued to work on the blockchain, and as a result, Toncoin has evolved into a fully decentralized, community-driven blockchain.

Toncoin is used to make transactions within the TON network, allowing users to send and receive digital assets with minimal fees. Thanks to the integration with Telegram, users can easily make transactions directly in the interface of the popular messenger, which greatly simplifies the process and makes it accessible to a wider audience.

One of the key features of TON is its high transaction speed and low commission cost, making it ideal for micropayments and everyday transactions. In addition, the project is actively developing decentralized applications (dApps), which expand the functionality of the network and provide users with new opportunities to use cryptocurrencies.

Toncoin is of interest to both short-term and long-term investors. For short-term investors, TON’s volatility may offer speculative trading opportunities. Long-term investors may see potential in TON due to its unique market position and close integration with Telegram, which could facilitate further growth and expansion of the ecosystem.

10. Cardano (ADA)

- Market cap: $15.2 billion

- Price: $0.42

- Price change over the last month: +8.8%

- Price change over the year: -28.6%

- Total supply: 37,075,829,454 ADA

Cardano (ADA) was launched in 2017 as a project based on scientific principles and carefully peer-reviewed research. Cardano’s developers aimed to create a more secure and resilient blockchain platform that would solve the major problems with scalability, interoperability, and system resilience that other cryptocurrencies face. The project was founded by Charles Hoskinson, one of the co-founders of Ethereum, which gave the project additional weight in the crypto community.

Cardano uses a unique dual-layer architecture consisting of a control layer (CSL) and a computation layer (CCL). This separation allows transactions to be processed separately from smart contract execution, making the platform more flexible and scalable. Additionally, Cardano uses the Ouroboros consensus algorithm, which is the first proven secure proof-of-stake (PoS) algorithm, significantly improving the energy efficiency of the network.

Cardano is attractive to long-term investors due to its commitment to innovation and the rigorous academic background that underpins the platform’s development. However, like any cryptocurrency, ADA carries risks, especially those related to potential technological setbacks, regulatory changes, and market data fluctuations. Short-term investors can use ADA’s volatility for speculative trading, but should be prepared for possible sharp price changes.

Comparison table of the top ten cryptocurrency market

The analysis below allows you to see how different cryptocurrencies stand on a number of key metrics, which can help investors and users understand which cryptocurrencies are best suited for their needs based on their priorities in technology, security, decentralization, and community.

| Cryptocurrency | Technology | Scalability | Safety | Decentralization | Team of developers | User community |

|---|---|---|---|---|---|---|

| BTC | PoW | Low (7 trans/sec) | High, historically stable | High | Not centralized, many contributors | Very active, many independent developers |

| ETH | PoW -> PoS | Moderate (30 trans/sec) | High, some smart contract hacks | High | Very experienced, active development | Very active, foundation for DeFi and dApps |

| USDT | Hybrid | Depends on the host blockchain | Average, questions on reserve transparency | Low | Centralized command of Tether | Widely used but less active |

| SUN | Hybrid (PoH + PoS) | High | Average, there were glitches | Average | Innovative, responsive | Active, growing, especially in NFT and DeFi |

| BNB | PoSA | High | High, centralized control | Low | Centralized, Binance | Very active, supportive of the Binance ecosystem |

| USDC | Hybrid | Depends on the host blockchain | High, audits | Low | Experienced, Circle and Coinbase support | Widely used in finance |

| XRP | RPCA | High (1500 trans/sec) | High but centralized control | Low (centralized control) | Experienced, focus on banking solutions | Active, many banking and financial partners |

| DOGE | PoW | Low | Average, reliable, but less secure | High | Community, no centralized team | Very active, many social initiatives |

| TON | Hybrid (PoW + PoS) | High | High, new network | Average | Community originating from Telegram | An active, growing community |

| THERE IS | PoS | High with sharding | High, focus on peer review research | High | Very experienced, academic approach | Very active, many projects on Cardano |

Top 10 Cryptocurrencies Comparison Table

Additional Factors to Consider When Investing in Cryptocurrencies

When investing in cryptocurrencies, there are many factors to consider to assess potential risks and opportunities. Here are some key aspects to consider:

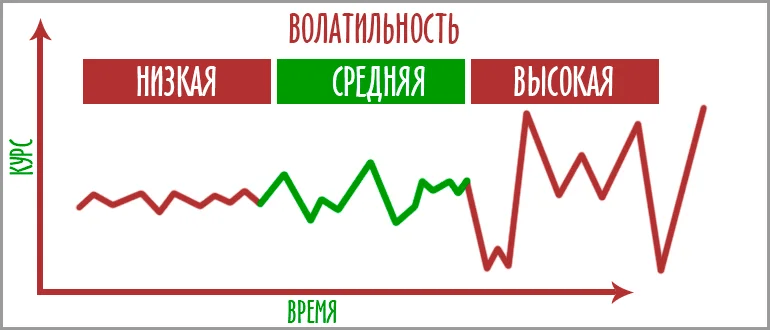

Market volatility

Cryptocurrency markets are known for their high volatility. Cryptocurrency prices can change dramatically over short periods of time, influenced by news, tweets from influential individuals, or large market trades. Investors should be prepared for potential short-term losses and take this into account when formulating their investment strategies. Volatility can offer both opportunities for quick profits and significant risks.

Regulatory environment

Cryptocurrencies are still in a relatively new area where the regulatory environment is still evolving. Different countries have different approaches to regulation, with some taking strict measures and others being more lenient. Changes in legislation can significantly impact the accessibility and value of cryptocurrencies. It is important for investors to monitor regulatory developments in the countries where they operate and understand how these changes may affect their investments.

Personal investment goals

Investment goals can vary greatly from investor to investor. Some are looking for quick profits from volatility trading, while others are interested in long-term investing only in projects that they consider technologically promising. Defining your investment goals will help shape your approach to asset selection, portfolio management, and risk levels.

Risk profile

Each investor should evaluate their individual comfort level with risk. Cryptocurrencies are generally considered high-risk investments. Determine how much of your investment capital can be allocated to speculative investments and how much loss you are willing to tolerate in the event of an unsuccessful investment. This will help you avoid situations where market fluctuations could negatively affect your financial situation.

Conclusion

Investing in cryptocurrencies requires careful analysis and understanding of the unique aspects of this market. By considering volatility, regulatory uncertainty, personal goals, and risk levels, investors can more effectively manage their portfolios and make informed investment decisions.

Автор Alex Smith

Имеет профессиональную подготовку в области микроэлектроники и аппаратного программирования, а также более 30-ти лет опыта работы с системами обработки и передачи данных, включая оборудование для майнинга криптовалют. Готовя материал для читателей блога BuyCrypt успешно применяет свой обширный технический бэкграунд для максимально точной передачи смысла материалов с используемых источников.