A cryptocurrency exchange is a trading platform or venue where an investor can make a transaction to buy, sell, or exchange one digital asset for another or for traditional fiat currency. Its key task is to support transactions with digital assets.

However, the functions of crypto exchanges are far from exhausted. Currently, the most popular trading platforms have done a great job of diversifying their areas of operational activity. For example, they began to provide clients with custody services for storing funds, as well as margin trading services.

Some exchanges are also teaming up with traditional companies, allowing them to expand the practical application of cryptocurrencies. They often issue cryptocurrency-backed debit cards that allow customers to cash out their digital assets in traditional currencies via automated teller machines (ATMs).

Initially, these platforms were mostly centralized (SEX), but over time, all the shortcomings of such a solution began to emerge. Mainly, these are hacker attacks. There are many known cases of exchange hacks, as a result of which users irretrievably lost money.

Decentralized cryptocurrency exchanges (DEX) are the next big thing in cryptocurrency trading. The first decentralized exchanges were very slow. Bisq, a company that allows people to find each other offline and make peer-to-peer transactions, introduced a more futuristic DEX in 2016. The platform used smart contracts to manage trading wallets in a traditional order-book model. This model was not compatible with Ethereum, lacked liquidity, and had a difficult user experience.

In 2018, a new generation of decentralized exchanges emerged. They used automated market makers, asset pricing dictated by permissionless protocols, and liquidity pools rather than buyers and sellers. In 2021, decentralized exchanges became very popular.

Below we will take a closer look at DEX exchanges, study their advantages and disadvantages and, of course, offer a list of interesting decentralized exchanges.

How are decentralized exchanges different from centralized ones?

Decentralized exchanges (DEX) do not have a single governing body as such. Exchanges are managed automatically or semi-automatically. In semi-automatic management, decisions about the development of the project are made by developers together with the community.

To enter decentralized exchanges, you do not need to register. Therefore, the exchange does not receive or store any data about users. To start trading on a decentralized exchange, you only need to create and connect a cryptocurrency wallet. The exchange does not store funds, so only users are responsible for their safety.

When trading on a decentralized exchange, a user trades directly with another user (P2P). When trading, they pay a commission only for the transaction. The commission size is dynamic and depends on the load on the blockchain network. There are no intermediaries between them charging additional commission. Therefore, in theory, the commission on decentralized exchanges is lower than on centralized ones. In practice, with a high load on the blockchain network, the commission level can be quite high.

Key Benefits of DEX

- anonymity: registration and KYC are not required;

- security of funds: decentralized exchanges do not store users’ funds, so there are no financial risks in the event of a hacker attack or an exchange collapse;

- No single point of entry: Working on a distributed ledger makes it impossible for hackers to hack and makes the attack pointless.

Main Disadvantages of DEX

- limited functionality: no margin trading, no ability to set Stop-Loss, etc.;

- low liquidity: the liquidity pool is smaller than on centralized exchanges, so there is a high probability of slippage;

- lack of support service: there is no single management, no technical support.

Types of DEX

Basically, decentralized cryptocurrency exchanges are classified according to two criteria:

Place of execution of transactions . The exchange can be carried out directly on the main blockchain, or on a third-party one, with the results subsequently transferred to the main one. The second method is often chosen in order to speed up and simplify the process if the base chain is heavily loaded.

Method of executing transactions . Some platforms support an order book system similar to that used on SEH. But recently, exchanges with AMM (automated market maker) have become increasingly popular. Their essence lies in the creation of liquidity pools by users, within which instant exchange is then carried out based on the rate determined by supply and demand.

How to choose DEX

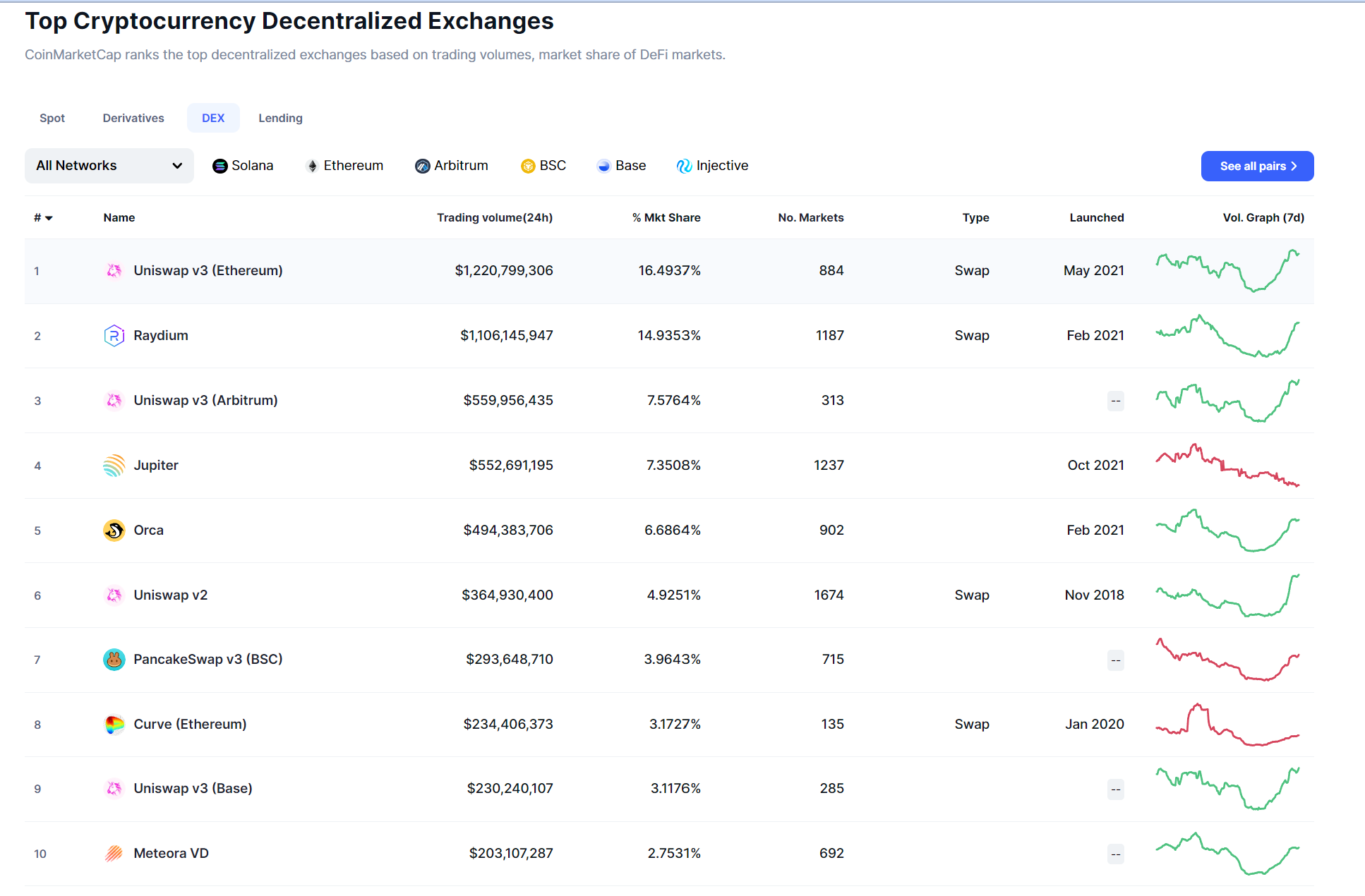

Top DEX exchanges according to coinmarketcap: https://coinmarketcap.com/rankings/exchanges/dex/

Choosing the best decentralized cryptocurrency exchange should be done according to your needs. The main factors are:

- Availability of the required trading pairs.

- Liquidity. The higher it is, the easier and faster trading will be.

- Security. Of course, in the case of decentralized exchanges, the user keeps his funds independently and does not provide confidential information to anyone. However, vulnerabilities in the protocol can lead to losses. Make sure that the protocol has been audited by independent companies.

- Commissions: When trading actively, fees can eat up a significant portion of your profits.

- Simplicity and convenience of the interface.

Ultimately, you are responsible for your funds. High asset volatility creates certain risks, and choosing the right platform is only one of the steps that can help you make profitable financial transactions.

Up-to-date information on trading volume can always be found on the CoinMarketCap and CoinGecko websites.

Decentralized Exchanges You Should Consider

1. DEX exchange Uniswap (first model AMM DEX)

Uniswap is a decentralized exchange (DEX) on the Ethereum blockchain that uses the automated market maker (AMM DEX) model. Unlike traditional exchanges, Uniswap does not rely on an order book. Instead, it uses liquid pools that are managed by smart contracts to enable trading.

Before Uniswap came along with a working AMM, trading on DEXs was slow and crypto assets on the exchange often traded at a premium compared to the same crypto assets on a CEX . This was because before AMMs, DEXs tried to mimic the way centralized exchanges executed trades. The problem was that the methods used by CEXs required a lot of computing power with low latency. Porting these methods to DEXs meant that they were much slower and still required some adjustment.

When the Uniswap DEX launched in 2018, it was revolutionary. The fact that you could swap Ethereum-based ERC20 tokens on the Ethereum blockchain without an order book was quite a feat. Instead, Uniswap used smart contracts that allow users to trade with each other without a middleman, making it decentralized and peer-to-peer in its environment.

Uniswap used innovative liquidity pools to create the assets needed for swaps. Users, like you, can add to pairs like ETH/DAI coins. In return, users earn a small percentage when using resources from this pool. Pricing is determined by how much of the asset remains in the liquidity pool.

The Uniswap interface is one of the great things about the platform. You can quickly link Uniswap to your MetaMask and swap tokens. The main goal was and is simplicity and efficiency. Uniswap is still, after all this time, at the forefront of decentralized finance.

Uniswap’s main goal is for users like you to run the exchange. This means that users will be helping the future of the exchange if they stake any of Uniswap’s tokens. As far as decentralized exchanges go, you can’t go wrong with DEX, which brought decentralized exchanges to the forefront. Many exchanges have since directly copied the Uniswap model due to its success and open source nature.

2. DEX exchange SushiSwap

Sushiswap , like Uniswap, is a decentralized AMM-based exchange protocol that uses liquidity pools. Any user can create a liquidity pool by providing any ERC-20 tokens or Ether of their choice. Prices are generated automatically. SushiSwap is community-driven – holders of the SUSHI token, distributed as a reward for providing liquidity, have the right to vote on project governance.

Sushiswap allows you to exchange tokens, manage your liquidity pools, and earn rewards for asset investment and staking.

SushiSwap is the number one food-themed decentralized exchange. In any case, SushiSwap has a lot in common with Uniswap, as it is a fork of Uniswap.

Controversially, SushiSwap launched a “Vampire Attack” on Uniswap, promising huge rewards and incentives for those who moved their funds to SushiSwap. Within two weeks, revenue increased by over $1 billion.

At the moment, SushiSwap continues to be one of the best decentralized exchanges. Rewards are distributed not based on the amount of the contribution or the number of shares, that is, those who have fewer shares also receive a certain profit. There are also sushi-themed rewards available.

The swap interface looks much more modern than Uniswap and is just as easy to trade on. Like the Uniswap V2 replica, you can find all the different options at the top, from pools to yields and analytics. If you ignore the controversy and are interested in staking rewards, SushiSwap is a great decentralized exchange to use.

3. DEX exchange PancakeSwap

PancakeSwap is a decentralized exchange (DEX) running on the Binance Smart Chain (BSC) blockchain using the automated market maker (AMM) model. The platform allows users to trade BEP-20 tokens directly through smart contracts without having to trust a centralized intermediary.

The main feature of PancakeSwap is the use of liquid pools, where users can deposit their tokens and receive a share of the fees for exchanges in return. Liquid pools are managed by smart contracts, which ensures transparency and security of all transactions. Users providing liquidity earn from the fees charged for each exchange.

PancakeSwap supports a wide range of BEP-20 tokens, making it a one-stop platform for exchanging various cryptocurrencies compatible with Binance Smart Chain. Users can connect their wallets, such as MetaMask or Trust Wallet, and make exchanges directly from their wallets, while maintaining full control over their assets.

The platform is also known for its low fees and fast transaction speeds thanks to the use of Binance Smart Chain, which offers more efficient and cheaper transactions compared to Ethereum. PancakeSwap also offers additional features such as yield farming, lotteries, liquidity pools, and an NFT marketplace.

Security is ensured by the decentralized architecture and transparency of the blockchain. All transactions occur through smart contracts, and users’ funds are stored in their own wallets until the moment of exchange, which significantly reduces the risks of hacking and theft.

PancakeSwap thus provides a powerful and user-friendly platform for decentralized cryptocurrency exchange and liquidity provision on the Binance Smart Chain blockchain, offering users high speed, low fees, and a variety of additional features.

4. DEX exchange 1inch Exchange

1inch is a decentralized exchange (DEX) and liquidity aggregator that operates on multiple blockchains, including Ethereum, Binance Smart Chain, and Polygon. The platform’s primary function is to find the best prices for users by combining liquidity from various DEXs and offering the most favorable terms for token swaps within the DeFi ecosystem .

1inch uses its own Pathfinder algorithm, which analyzes prices on various exchanges and routes trades in a way that minimizes costs and maximizes the amount of tokens received. This allows users to avoid the large spreads and high fees often found on individual exchanges.

The platform supports a variety of ERC-20, BEP-20 and other tokens compatible with supported blockchains. Users can connect their wallets such as MetaMask, Trust Wallet and others to perform exchanges directly, while maintaining full control over their assets.

1inch also offers liquid mining and staking, allowing users to earn tokens for providing liquidity to pools and participating in the network. The platform’s native token , 1INCH, is used for governance, giving holders the ability to vote on important protocol developments.

Security on 1inch is ensured by a decentralized architecture and the use of smart contracts, which make transactions transparent and reliable. User funds are never stored on the platform, which reduces the risk of hacking and theft.

Thus, 1inch offers users a convenient and efficient platform for decentralized cryptocurrency exchange, combining the best prices from various DEX, minimizing costs and providing additional opportunities to earn through liquid mining and staking.

5. DEX exchange dYdx

dYdx is a multifunctional peer-to-peer platform that allows you to trade, borrow and lend tokens. This platform works using an order book — a classic order book. It also allows you to create margin positions with leverage up to 10x. And by holding funds in the account, you can earn a variable interest rate.

dYdX aggregates spot and credit liquidity from multiple exchanges, providing maximum flexibility. Access to trading is very fast, no registration is required.

The decentralized platform from the Binance exchange also works on the order book principle. Assets that are located on the Binance Chain blockchain are available for trading. The comparison is carried out within the blockchain nodes, and all transactions are recorded in it, thus forming a complete and transparent history of activity.

The logic of order matching on DEX is somewhat different from a regular centralized exchange. There is a testnet – a test network where you can try your hand at trading without investing real assets and understand the essence of the platform.

6. DEX exchange Curve

Curve is an Ethereum liquidity pool designed for trading stablecoins with high efficiency and low slippage. It also features a reduced level of commission fees. The protocol is designed specifically for stablecoins and fully takes into account their features. Tokens in liquidity pools also interact with external protocols, such as Compound.

The existing pools within Curve allow for exchanges with a wide range of stablecoins, both dollar-denominated and tokenized Bitcoin. The native token CRV is distributed as a reward for providing liquidity.

7. DEX exchange Bancor

Bancor is a decentralized exchange (DEX) running on the Ethereum blockchain that uses automated market makers (AMMs) to provide liquidity. Unlike traditional exchanges, Bancor does not use an order book. Instead, it relies on liquidity pools run by smart contracts, where users can deposit their tokens and earn fees for every transaction that occurs in the pool.

The key feature of Bancor is its use of its native token, BNT, which acts as an intermediate asset in exchanges between different tokens. This allows for exchanges between any supported tokens without the need for direct trading pairs. With this model, Bancor provides constant liquidity and eliminates the need for third-party buyers and sellers.

Bancor ensures the transparency and security of transactions by recording them on the Ethereum blockchain. The platform reduces the risks associated with centralized exchanges, such as hacks and fraud, thanks to its decentralized architecture. Users can also earn on their assets by providing liquidity to pools and earning income from exchange fees.

8. DEX exchange Aave

Aave is a decentralized exchange (DEX) and lending platform running on the Ethereum blockchain. It allows users to borrow and lend cryptocurrency through smart contracts without intermediaries. Users can deposit their assets into liquid pools to earn interest and borrow using collateral.

Aave’s key feature is its floating and fixed rate lending system, which provides flexibility and the ability to choose the best loan terms. In addition, the platform offers unique features such as flash loans, which allow you to borrow without collateral, provided that you pay it back in a single transaction.

Aave also provides a high level of security thanks to the decentralized structure and transparency of the Ethereum blockchain. All transactions and operations are managed by smart contracts, eliminating the need to trust third parties and minimizing the risks of hacking and fraud. Users can control their assets and receive transparent information about the status of their loans and deposits in real time.

As such, Aave offers innovative solutions for decentralized lending and trading, providing users with security, flexibility, and transparency.

9. DEX exchange Paradex

Paradex is a decentralized exchange (DEX) that runs on the Ethereum blockchain. It allows users to trade cryptocurrencies directly with each other, without the need for a centralized intermediary. Paradex uses smart contracts to ensure secure and transparent transactions, eliminating the need to trust third parties.

One of the key features of Paradex is its support for ERC-20 tokens, allowing users to trade a variety of different cryptocurrencies compatible with Ethereum. Users can connect their wallets, such as MetaMask, to the platform and start trading while maintaining full control over their assets.

Paradex also provides a high level of security, as user funds are never stored on the platform. All transactions occur directly from user wallets through smart contracts, which minimizes the risks of hacking and theft.

In addition, Paradex provides a user-friendly and intuitive interface that makes trading easier even for beginners. The platform offers features such as viewing orders, trading history, and various tools for market analysis.

Thus, Paradex combines the benefits of decentralization, security and convenience, offering users a reliable way to trade cryptocurrencies on the Ethereum blockchain.

10. DEX exchange KyberSwap

KyberSwap is a decentralized exchange (DEX) running on the Ethereum blockchain that allows users to exchange cryptocurrencies directly through smart contracts. The platform is part of the Kyber Network ecosystem, known for its liquidity aggregation technology that aggregates liquidity from various sources to provide the best exchange rates.

One of the key features of KyberSwap is the instantaneous exchange of tokens, which is achieved through the use of liquidity aggregation. This allows users to find and execute trades with the best available rates, without the need to create orders or wait for them to be executed. Transactions are fast and secure, thanks to the use of smart contracts.

KyberSwap supports a wide range of ERC-20 tokens, making it a versatile platform for exchanging various Ethereum-compatible cryptocurrencies. Users can connect their wallets, such as MetaMask, Trust Wallet, or other compatible wallets, and exchange tokens directly from their wallets without transferring funds to a third party.

Security is an important aspect of KyberSwap. Users’ funds are not stored on the platform, but remain in their personal wallets until the exchange takes place, which significantly reduces the risk of hacking and theft. All transactions are carried out through smart contracts, which ensures the transparency and reliability of transactions.

Additionally, KyberSwap offers a user-friendly and intuitive interface that makes the exchange process simple and accessible even for beginners. The platform provides tools for price monitoring, transaction history, and other analytical tools that help users make informed decisions.

Thus, KyberSwap combines the benefits of decentralization, security and convenience, providing users with a reliable and efficient way to exchange cryptocurrencies on the Ethereum blockchain.

How to get started with DEX

The way you get started with a decentralized cryptocurrency exchange depends on the type of exchange.

Some, like Binance Dex, require you to create a separate cryptocurrency wallet. You will need to set a password, save the keys and seed phrase, which you will later need to access your funds.

Other DEXs work in conjunction with web3 wallets (such as Metamask or Trust Wallet) or hardware wallets Ledger, Trezor. In this case, you need to click the Connect Wallet button or something similar, then enter the password from your wallet to use funds in working with the protocol. With each transaction, the wallet will ask for the user’s permission.

In both cases, the user is not required to provide any data — no phone number, no email, not to mention name or address. Trading is completely anonymous.

It is important to note that developers’ failure to list tokens on decentralized exchanges sometimes leads to the distribution of counterfeit tokens. Therefore, before trading tokens, it is necessary to check information about the project on CoinMarketCap and CoinGecko.

The concept of development of decentralized exchanges

Decentralized exchanges (DEX) represent a new stage in the development of financial technologies, providing users with platforms for trading cryptocurrencies without having to rely on centralized intermediaries. The concept of DEX development is based on several key principles that make them attractive and promising for the future of financial systems.

The main advantage of decentralized exchanges is that they provide greater security and privacy for users. Since DEXs operate on smart contracts and blockchain technology, users’ funds are stored in their own wallets rather than in centralized accounts. This reduces the risk of hacks and fraud that often occur with centralized exchanges.

Transparency of operations is another important aspect of DEX. All transactions and trades are recorded on the blockchain, making them available for verification and audit. This eliminates the possibility of manipulation and increases trust in trading processes. Combined with open source code, this ensures a high level of transparency and decentralization of the platform’s governance.

One of the important goals of decentralized exchanges is to increase the liquidity and availability of trading pairs. To achieve this, automated market makers (AMMs) are being introduced, which use algorithms to determine prices and provide liquidity without the need for traditional orders. This allows users to trade at virtually any time and with any volume.

Interoperability and scalability are also key areas of DEX development. The introduction of cross-chain solutions allows for the exchange of assets between different blockchains, which expands the possibilities for trading and integrating different ecosystems. Modern scaling technologies, such as Layer 2 solutions, help increase throughput and reduce transaction fees.

However, decentralized exchanges also face a number of challenges. One of them is the complexity of use and the need to educate users on new technologies. To solve this problem, developers are focusing on creating more intuitive interfaces and educational programs. Another challenge is regulation, since DEXs operate outside the traditional legal system, which requires the development of new approaches to legal regulation and protection of user rights.

Looking ahead, the development of decentralized exchanges will continue to accelerate due to constant innovation and increased user awareness of the benefits of decentralization. Improved user experience, increased liquidity, and integration with various blockchain ecosystems will be the main drivers of DEX growth and popularity, which may ultimately lead to significant changes in the global financial system.

Автор Evgeniy

IT предприниматель. Консультирую команду Buycrypt по организации децентрализованной экономики. Разрабатываю стратегию вывода на рынок ценностного предложения токена. Работаю над математическими моделями: - повышение эффективности торговли фонда методом коллективного принятия решений. - коэффициент интеллекта трейдера для расстановки весов влияния на коллективное решение. - расчет справедливости распределения доходов и вклада. - прогностический алгоритм на основе реакций масс. - система принятия решений и организация ввода/вывода активов.