There are two types of exchanges in the cryptocurrency markets : centralized (CEX) and decentralized (DEX).

In this guide, we’ll cover what a cryptocurrency exchange can be, explore the differences between them, and what risks you need to consider when trading on each exchange.

CEX vs DEX: What’s the Difference?

Centralized exchanges (CEXs), such as Binance , are online trading platforms that match buyers and sellers through an order book. They essentially work like online brokerage accounts, which is why they are so popular among investors.

Decentralized exchanges (DEXs), such as PancakeSwap or Uniswap , are autonomous financial protocols powered by smart contracts that allow crypto traders to convert one digital asset into another, with all transactions appearing on the blockchain.

- The main difference between centralized and decentralized exchanges is that the former controls your funds while you interact on the trading platform, while the latter allows users to retain control of their funds while trading.

But the security of funds is not the only difference between the two types of exchanges.

Let’s dive into the pros and cons of each type of exchange to learn more about what each trading platform has to offer and how they differ.

What is a Centralized Exchange (CEX): Pros and Cons

Although centralized exchanges are considered less secure than their decentralized counterparts because they store investors’ funds, they have a number of features and benefits that attract users to them.

Pros

1. Trading volumes

Centralized exchanges are usually very liquid. Binance, for example, regularly records daily trading volumes of over $30 billion. For beginners, these active platforms essentially guarantee that their assets can be exchanged without any hassle at any time. For experienced traders, CEXs provide a way to move relatively large amounts of funds in and out of the exchange in minutes.

2. Fiat/crypto and crypto/fiat currency conversion

Centralized exchanges usually support fiat cryptocurrency switching on and off. This means that they allow you to buy Bitcoin with US dollars, for example.

3. More opportunities

Apart from the huge number of digital assets supported by CEX, they offer many more features beyond exchanging one asset for another, such as margin trading, crypto derivatives trading, exchange staking, and margin lending, among others.

4. Ease of use

One of the appealing features of most CEXs is the user interface. Considering that most newcomers are unfamiliar with crypto pairs or simple terms like “long or short,” CEXs do a great job of guiding users into the crypto space. Some CEX platforms, like Binance, have lightweight versions for users looking to do basic trading. What’s more, they function almost exactly like online brokers, thus acting as a familiar face to traditional investors.

Cons

While centralized trading platforms have many advantages for investors who are accustomed to their online brokerage accounts, they have a number of significant disadvantages.

1. Strict Know Your Customer (KYC) policy

For users who want to maintain privacy while trading, CEX is not the right exchange. Centralized exchanges are subject to strict KYC policies. They usually require you to upload a photo of your face and a valid ID to buy and sell cryptocurrency or withdraw funds.

2. Not your keys – not your coins

While CEX provides easy trading, high liquidity, etc., they provide you with wallets, which means they have power over your crypto. A crypto wallet should not be controlled by a third party. Using the famous phrase “not your keys, not your coin,” it is safe to say that CEX wallets pose a security risk to traders and investors.

3. Hacking

In recent years, we have seen several infamous hacks of crypto exchanges where they lost billions of dollars. Since exchanges hold users’ funds centrally, they are prime targets for cybercriminals looking to get their hands on cryptocurrency.

What is a decentralized exchange (DEX): pros and cons

Decentralized exchanges have gained a significant share of the cryptocurrency trading market as a result of improved usability and growing awareness among users of the importance of maintaining control over their private keys.

Pros

Some of the features that attract users to DEX include:

1. Confidentiality and anonymity

Using a decentralized exchange typically requires only connecting a wallet and signing a transaction. No identity verification is required.

2. Security

Decentralized exchanges are generally more secure than centralized ones for two reasons:

- They are not storage related: hackers are interested in exchanges with a central database, in order to extract users’ private keys and withdraw their funds. Since DEX does not store your private keys, hackers cannot get into your wallet.

- No identity checks: no risk of leaking user personal data.

3. DeFi and NFT Integration

DeFi and NFTs are two frontiers of the blockchain space, and DEXs are strong drivers. DEXs allow users to access the world of smart contracts and DApps that provide financial services, including lending and savings products, as well as NFT projects.

Cons of DeFi and NFT Integration

While decentralized trading platforms have some significant advantages over centralized exchanges, they also have disadvantages that new crypto investors should be aware of.

1. Limited trade

DEX functionality is currently limited. Features such as margin trading, limit orders, futures, options, etc. are generally not available.

2. Efficiency

Decentralized exchanges are not as fast and efficient as CEXs due to the scalability issues that most blockchains face. Centralized exchanges do not face this problem because they use mechanisms both on and off-chain to ensure smooth operation.

CEX vs DEX Comparison: What Are the Risks?

Trading and investing in cryptocurrency comes with risks no matter what type of exchange you use. However, the risks posed by the two types of trading platforms are different.

CEX

- Hacking is a real threat to centralized exchange users who store funds on their servers. It has happened before and will likely continue to happen, especially when using smaller exchanges.

- CEXs are subject to financial regulations that can change overnight, creating potential risks to the funds stored in your wallet. For example, if the exchange is under investigation, your funds may be temporarily frozen or, in extreme cases, even seized.

- Centralized exchanges usually require verification of your identity. In the event of a data breach, this could result in your personal information being put up for sale on the dark web. In this case, you could become a target for hacking, fraud, or identity theft.

DEX

- DEXs are non-custodial, meaning that only you control your funds. However, if you lose your wallet recovery phrase, you will lose your cryptocurrency. That is why you should carefully store your key in a safe place.

- Decentralized trading platforms are built using smart contracts, which creates a certain degree of risk associated with the code. This means that if there are bugs or vulnerabilities in the trading platform’s code, hackers can exploit them and funds will be lost. Unfortunately, this happened a lot in the early days of the DeFi boom in 2020. To reduce this risk, it’s best to stick to leading DEXs.

CEX vs DEX: Comparison Summary

Both types of crypto exchanges allow users to buy and sell cryptocurrency, with differences in key elements such as liquidity, security, and usability.

For newcomers looking to join the crypto space, CEXs provide a simple and fast way to trade. On the other hand, DEXs are more suitable for experienced traders who want privacy and full control over their digital funds.

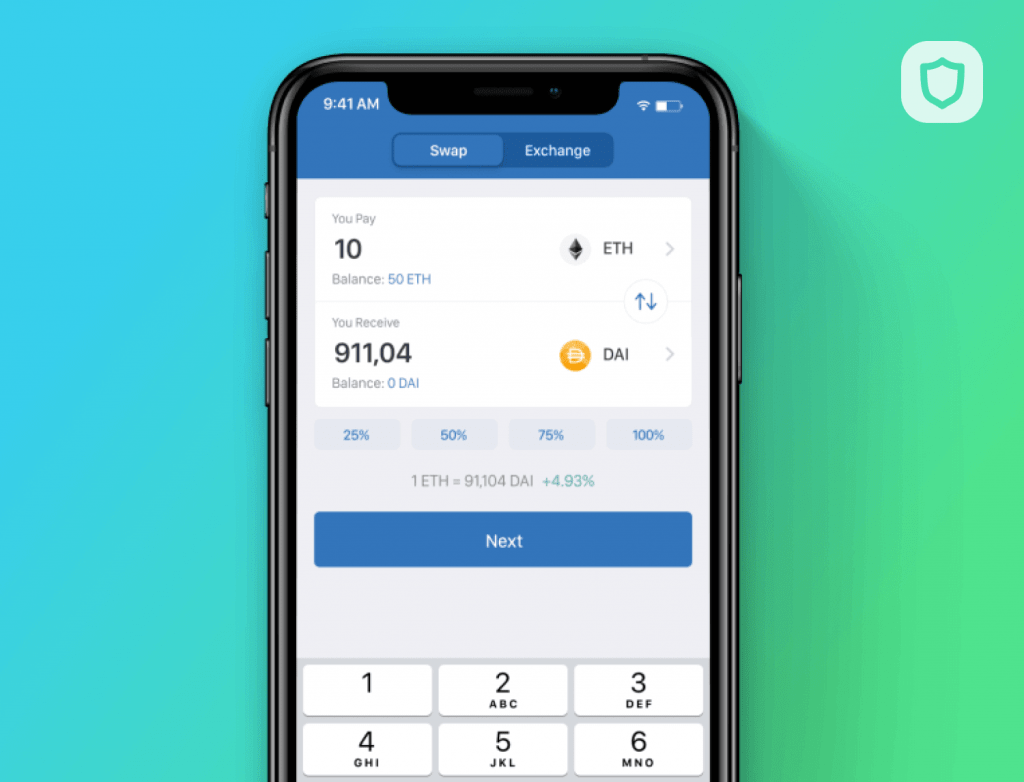

Trust Wallet – a unique combination

Trust Wallet offers decentralized trading right in the app to provide the convenience of using cryptocurrency to its full potential. The mobile wallet supports over 40 blockchains and over 160,000 digital assets, allowing you to buy and store any crypto asset of your choice in a simple and beginner-friendly way.

The market-leading multi-currency wallet also allows you to enter the world of DeFi, DApps and NFTs using the in-app DApp browser in a simple and secure way.

Автор Alex Smith

Has professional training in microelectronics and hardware programming, as well as over 30 years of experience working with data processing and transmission systems, including cryptocurrency mining equipment. When preparing materials for blog readers, BuyCrypt successfully applies its extensive technical background to convey the meaning of materials from the sources used as accurately as possible.