It may not be a secret to many that the crypto market (and not only crypto) goes through different cycles. Typically, these cycles can be divided into three main categories: decline, consolidation, and growth.

Following Bitcoin’s history, these stages occur over a period of about 4 years.

First, the first cryptocurrency is distributed between buyers and sellers (consolidation). Then, when supply is lower than demand, the price moves rapidly upwards, setting new price highs. After that, early investors start taking profits, and a crowd, hoping not to miss out, begins buying crypto. Next, demand falls while supply increases due to the mining of new coins, and the price starts to move down until it finds a new local bottom. After that, consolidation happens again, and a new cycle begins.

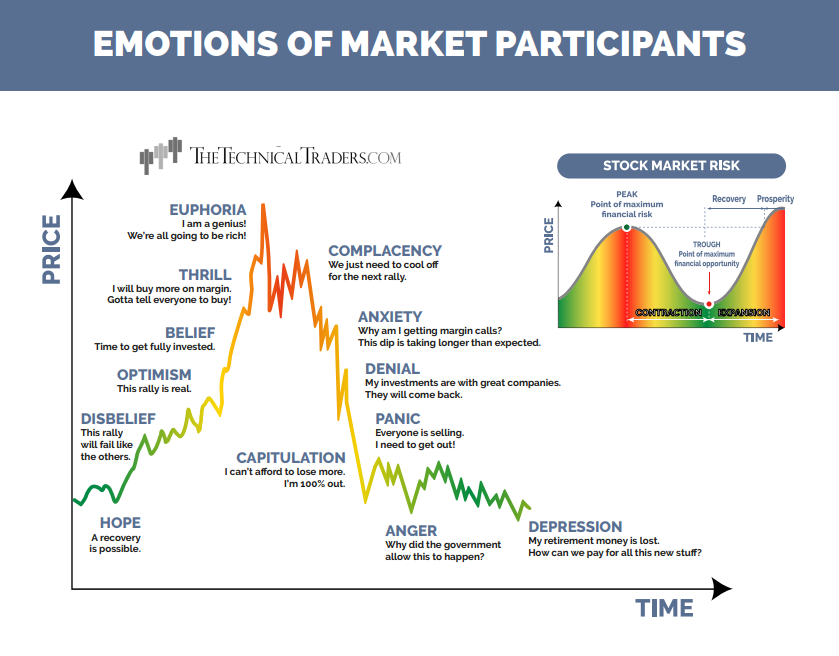

Cycles are also often associated with certain emotional states (see the image), which can help us determine which stage the market is in.

If we refer to previous cycles, we can assume that we are currently between the «Optimism» and «Belief» stages, which suggests there is still room for growth. This is also supported by many indicators and market events that traders and investors are anticipating (mass adoption of BTC by corporations and countries as a reserve and a safety net against inflation).

Referring to past cycles:

— On average, BTC grew from ATH to new peaks by 200%.

— BTC dominance did not reach the critical 68-70% level.

— Retail demand is still absent.

— On Google Trends, BTC is at 46 points (for comparison, in 2018, at the peak of the price, it was around 100 points, and in 2021, it was 72 points).

Conclusion: Based on the analysis of previous cycles, many indicators suggest that there is still room for growth. However, remember not to let greed ruin your profits. Sell gradually as the price rises, try to recover your initial investment, but never fully exit strong assets. You should maintain your position in the market. If you’re a beginner and have just started building a position, be prudent and don’t invest the entire amount at once. Be prepared to hold the asset for at least 5 years, and when the market dips, buy the bottom. Only routine and a clear head will help you profit from the market.