🔑 Key Points

Before starting futures trading on exchanges, it’s essential to understand the platform’s principles and features. In this guide, we’ll cover the key questions and settings important for trading perpetual futures on the BuyCrypt platform.

Always remember the risks associated with futures trading. You should only begin trading once you are adequately prepared and understand how this product works. Futures trading requires technical skills and a solid understanding of basic trading principles. At first glance, the BuyCrypt interface may seem complex, but this guide will help you quickly master its capabilities.

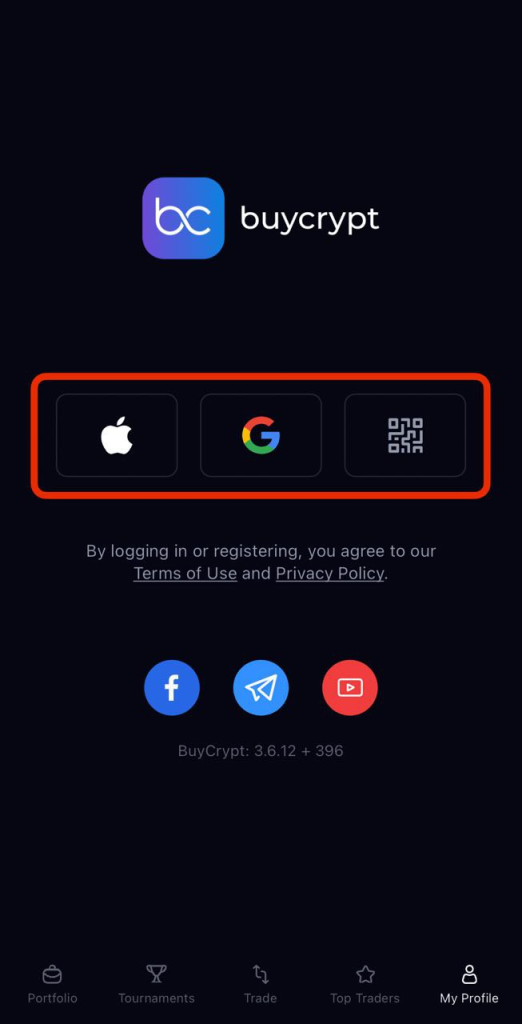

📝 How to Create an Account on the BuyCrypt Platform

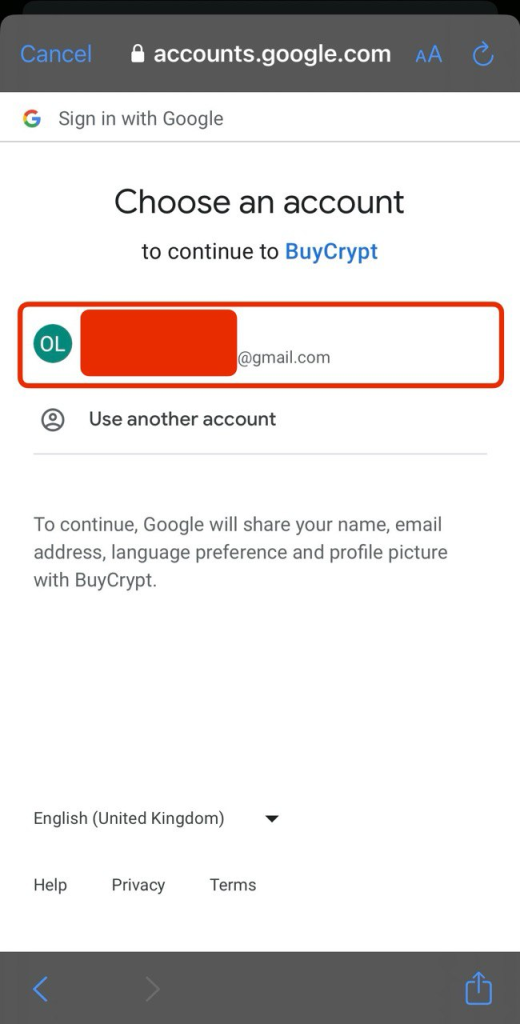

To open an account on the BuyCrypt platform, you will need an Apple ID or Google ID. To do so, navigate to the My Profile screen in the app and follow these steps:

- Choose the registration method that suits you.

- Confirm your login via the selected method.

Afterward, you’ll land on the Portfolio screen, where all connected accounts will be displayed, including your prize USDT and demo account for tournaments.

📊 Portfolio Overview

This section of the app is divided into two main categories for easy monitoring of personal assets:

- 💼 All Assets — Displays spot assets across all connected API keys.

- 📈 Positions — Shows all your open positions and their current PnL (profit/loss).

👨💻 Overview of the BuyCrypt Trading Interface

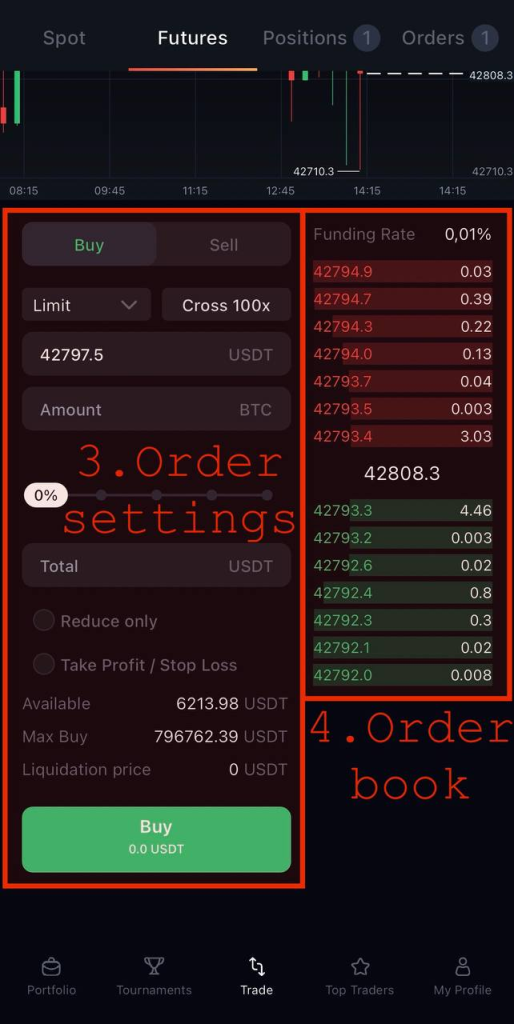

- General Menu

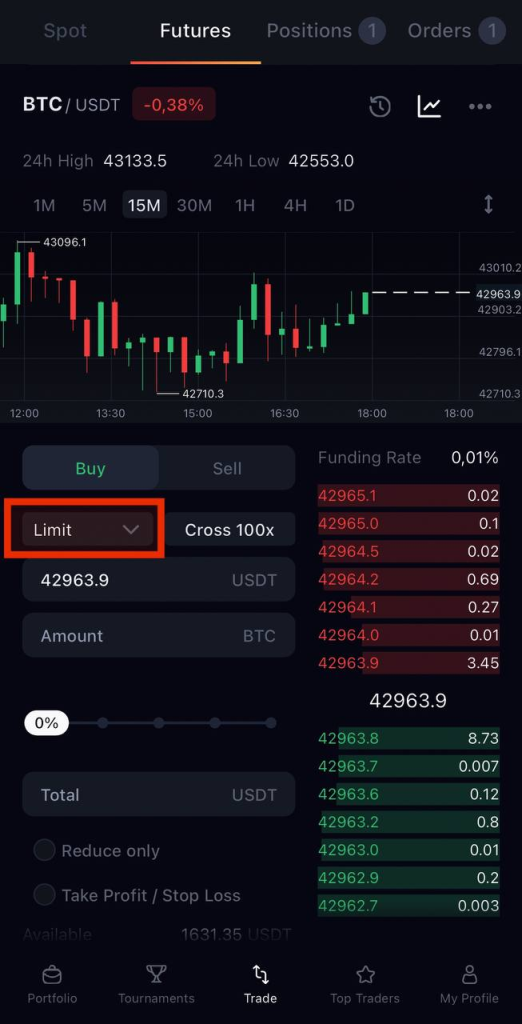

At the top of the screen, you can select the type of trading (spot or futures), view your positions or orders, and choose the trading key if you are trading on multiple exchanges. - Price Chart

This section is for monitoring the current price and analyzing its movement over a selected period. You can switch the time frame in the top part of the chart. - Order Settings

Here, you can place an order with the desired type and parameters. More details on order types are in the section below. - Order Book

This part of the screen shows the order prices and the number of coins in the orders placed by other traders on the exchange.

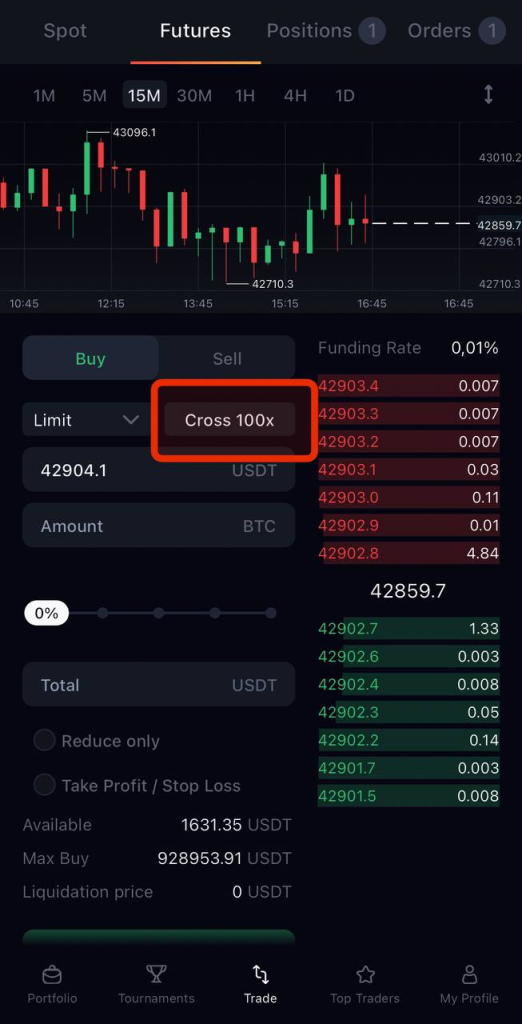

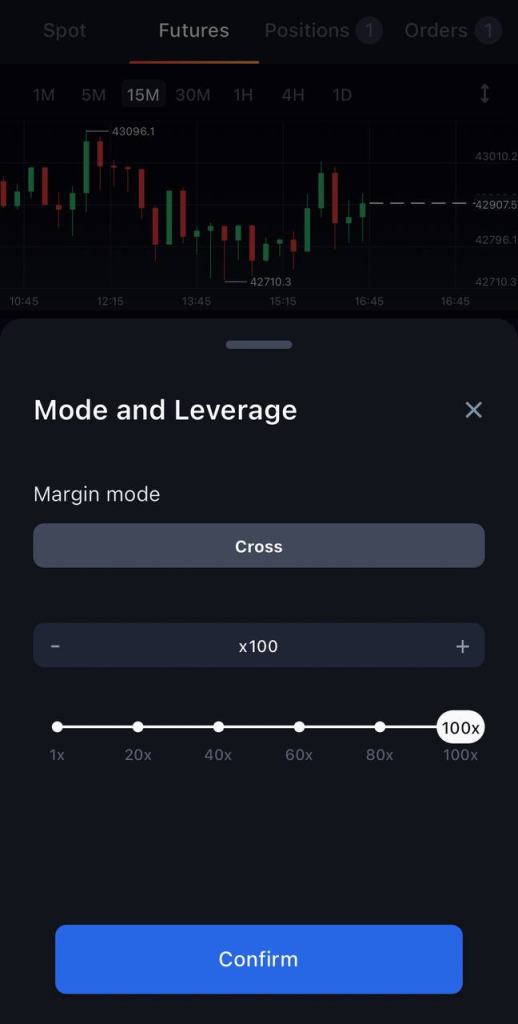

⚖️ Leverage Settings

BuyCrypt allows you to manually adjust the leverage.

To set leverage, go to the order input field and click on the current leverage level (default is 20x). Choose the desired leverage using the slider or enter the number manually, then click Confirm.

Keep in mind that the larger the position, the smaller the available leverage, and vice versa. Higher leverage increases the risk of liquidation. Always assess your leverage and the associated risks carefully.

💡 What’s the Difference Between the Mark Price and the Last Price?

- Last Price — This is the price of the last transaction for the contract. It is used to calculate the realized PnL.

- Mark Price — This is the price used to prevent manipulation. It is calculated based on funding data and prices from multiple exchanges. It determines liquidation and unrealized PnL.

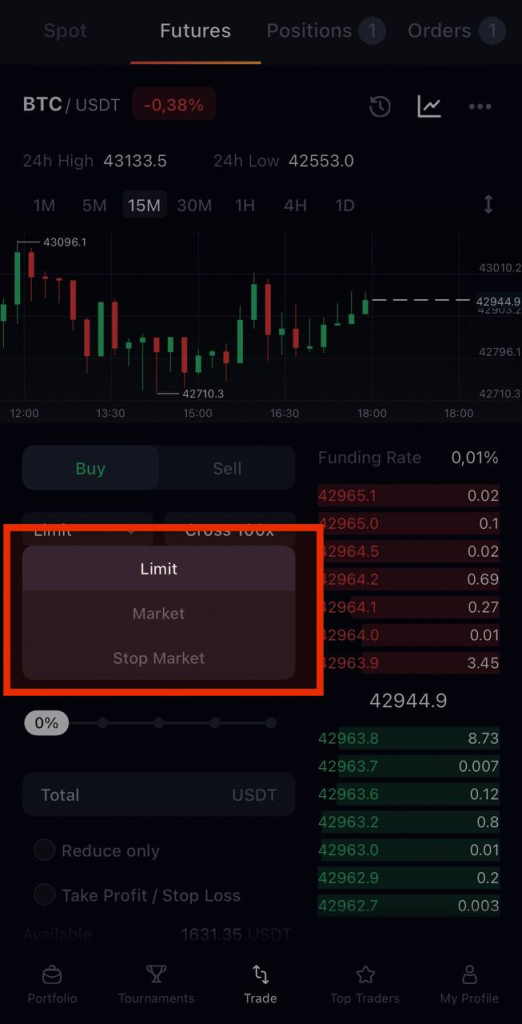

📑 Available Order Types and Their Use Cases

- 💵 Limit Order — Executed when the market price reaches the set limit price. Used to buy below or sell above the market price.

- 📈 Market Order — Executed at the best current market price and used for immediate buy or sell actions.

- ⏳ Limit Stop Order — Activates a limit order when the stop price is reached.

- 🔔 Market Stop Order — Executed as a market order when the stop price is reached.

- 🛡 Limit Take Profit — Used to lock in profits when the target price is reached.

📊 How to Use the BuyCrypt Calculator

The calculator helps you calculate parameters before entering a position, such as PnL, target price, and liquidation price.

💸 Funding Rate

The funding rate keeps the perpetual futures price close to the spot price. Traders pay each other based on the difference between the futures price and the spot price.

❗️ Liquidation Conditions

Liquidation occurs when the margin balance falls below the maintenance margin level. To avoid liquidation, monitor your positions and close them in time.

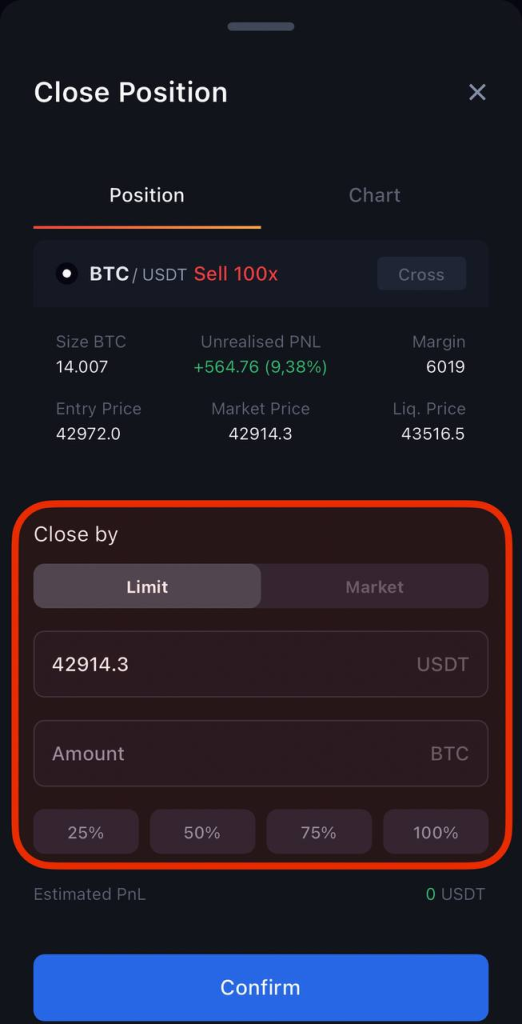

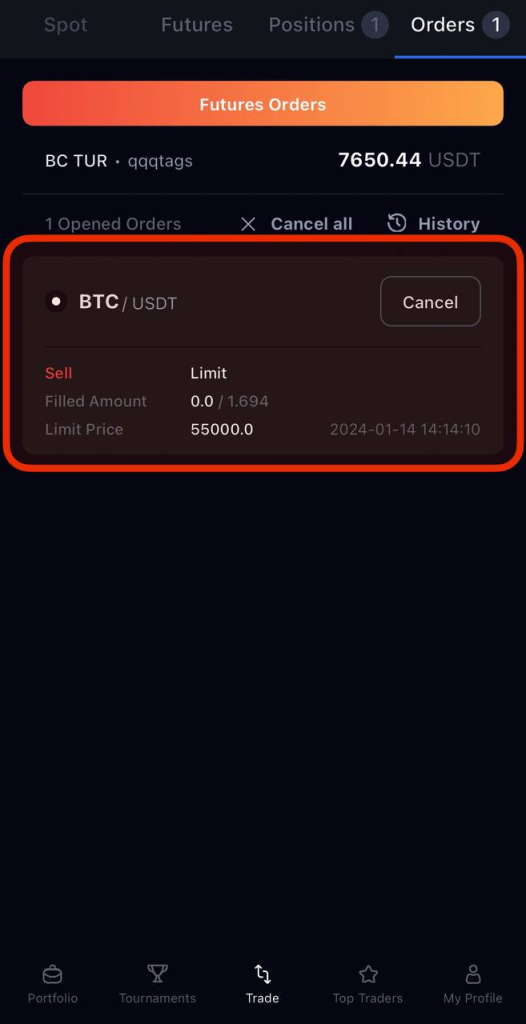

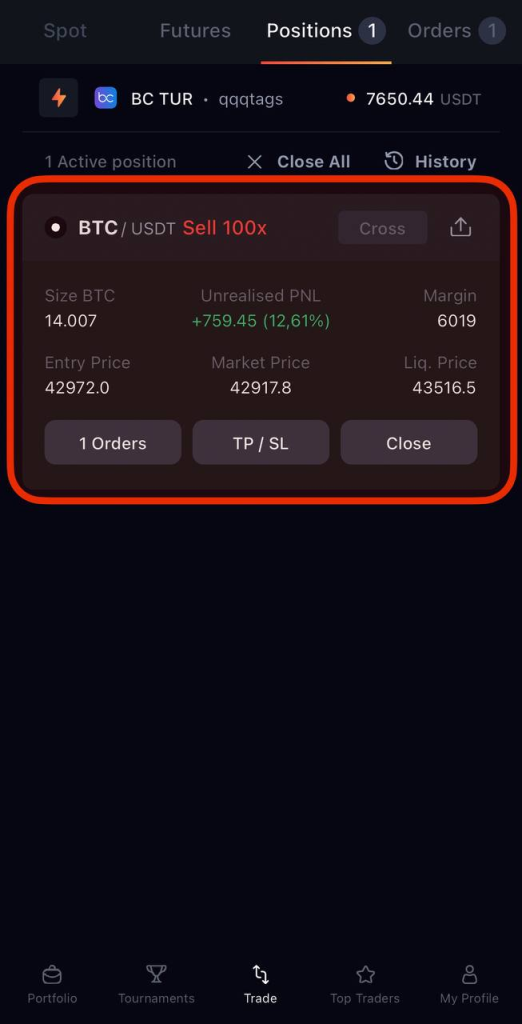

🔄 Monitoring and Managing Open Positions

This screen displays all the critical information about your position: trading pair, leverage size, position volume, PnL, entry price, and liquidation price. You can also manage closing positions from here.