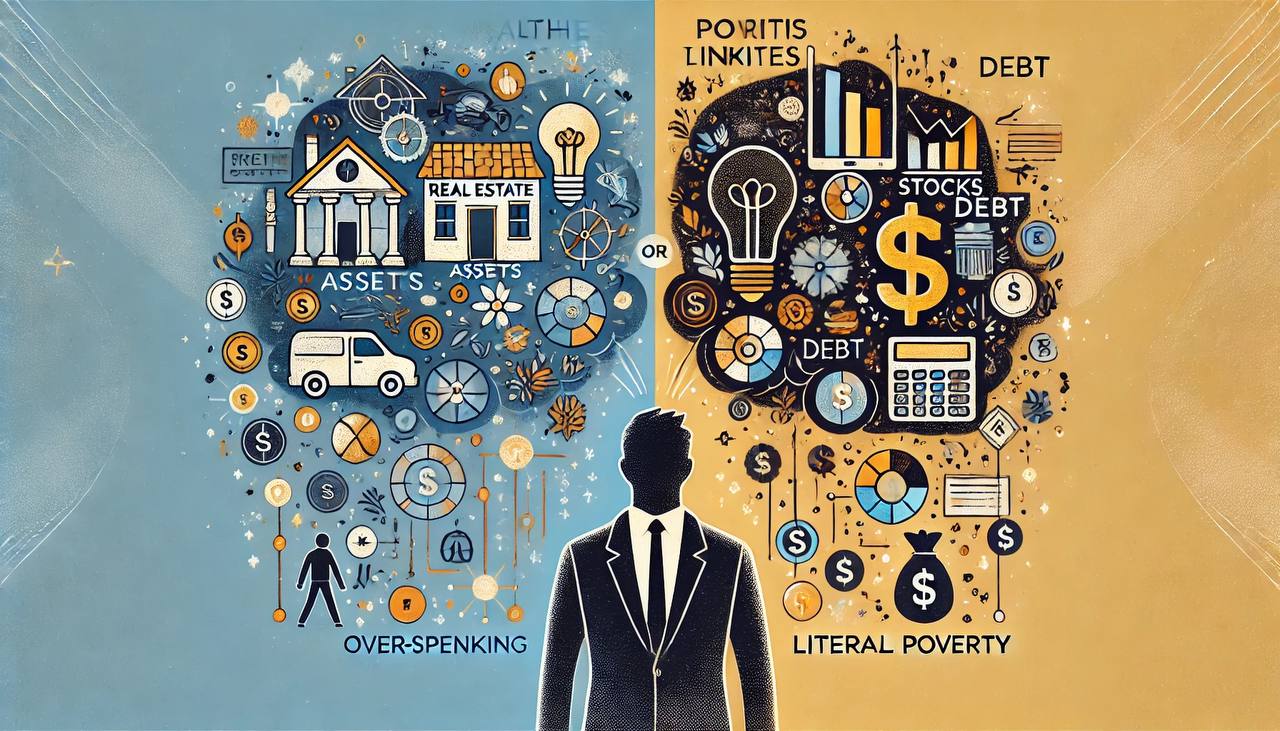

Assets and liabilities are one of the most important aspects of financial well-being, and understanding what they are and how they affect your life is absolutely crucial. Many of us hear these terms often, but don’t always understand what they mean in the context of personal finance. In this article, we will look at how the mindset of a “rich” person differs from that of a “poor” person when it comes to money, and why understanding assets and liabilities can be the key to your success.

What are Assets and Liabilities?

Let’s start by breaking down these terms. Assets are things that bring in money. These can be real estate, businesses, stocks, bonds, securities, or even skills and knowledge that you can monetize. Liabilities, on the other hand, are things that take money away from you. Liabilities are debts, loans, expenses related to maintaining property, unnecessary purchases that don’t bring in income but require constant spending. Rich people focus on accumulating assets that generate income, while poor people often focus on liabilities that drain their money and resources.

A poor person’s mindset is focused on spending the money they receive as quickly as possible. For the poor person, money is a tool for consumption. They buy things that don’t bring in income but satisfy short-term desires. For example, they may take out a loan to buy a new expensive car or gadget, even though they already own a mid-range car with a paid-off loan. While the purchase may bring them pleasure, it is not an asset, but rather a liability. Poor people often think: “I’ll earn money, spend it on needs, and be happy.” They don’t always see how they can invest money in things that will work for them. For example, buying a new car that requires monthly loan payments, insurance, and maintenance expenses may look like a “necessity.” However, it’s more of a liability because the car doesn’t generate income but instead takes away money.

The mindset of a rich person, on the other hand, understands the importance of assets and strives to accumulate them. They invest money in businesses, real estate, stocks, or other instruments that generate income. A rich person’s mindset can be described as “invest, not spend.” For instance, they may invest in real estate that they can rent out, providing steady income. For the rich, money is a tool to create wealth, not just a means of consumption. They prefer to buy assets that will work for them in the long term, rather than liabilities that require ongoing expenses. For example, a rich person may buy real estate that generates rental income or invest in stocks of companies that pay dividends. These assets generate a continuous cash flow, allowing them to grow their wealth.

Examples of Assets and Liabilities:

Assets:

– Rental real estate — generates regular income.

– Investments in stocks or bonds — can bring dividends or interest income.

– A business — if you own a business that generates profit.

– Education and skills — these can be an asset if your knowledge and experience help you earn more.

Liabilities:

– Loans and debts — money you owe that requires regular payments.

– Expensive cars — cars that don’t bring in income but require maintenance costs.

– Excessive consumer spending — expensive items that bring short-term pleasure and won’t be used more than a few times.

– Unused assets — for example, vacant real estate that you can’t rent out or sell.

How to Change Your Mindset?

1. Awareness — start realizing that every dollar spent on liabilities decreases your wealth. This doesn’t mean you have to give up everything, but it’s important to spend wisely.

2. Investing — start investing money in assets. Even a small amount can work for you in the long run. For example, invest in real estate, stocks, or even your education, which will increase your income.

3. Long-Term Thinking — rich people plan their finances for years ahead. Instead of thinking about short-term pleasures, they make choices that favor investments that will bring money in the future.

Conclusion

The main difference between the mindset of a rich and poor person lies in how they view money. Poor people tend to spend money on liabilities that don’t bring income, while rich people focus on accumulating assets that ensure financial independence. Understanding the difference between assets and liabilities and making the decision to invest in assets can significantly change your financial situation. By starting small, you can build a solid financial foundation and eventually create sources of passive income that will work for you.