Tether (USDT) is one of the most well-known and widely used cryptocurrencies, which is classified as a stablecoin. This means that its value is tied to the value of another asset, in this case, the US dollar. Tether aims to provide a cryptocurrency equivalent to the dollar, combining the benefits of cryptocurrencies, such as the speed and security of transactions, with the stability of traditional currencies. This makes Tether an ideal tool for cryptocurrency traders and investors who are looking for a refuge from market volatility without having to withdraw funds into fiat currencies.

In the cryptocurrency space, Tether occupies a key place as it acts as a bridge between the worlds of traditional finance and cryptocurrency. Due to its stability, USDT is often used to store funds during market volatility, to facilitate transactions on cryptocurrency exchanges, and as a means of providing liquidity. On almost every cryptocurrency exchange, USDT is one of the main trading pairs, allowing users to easily move between different cryptocurrencies without having to convert funds to fiat each time. Tether also plays an important role in funding and disbursement on international platforms where traditional currencies may face banking restrictions or high fees.

What are stablecoins

Stablecoins are cryptocurrencies that are specifically designed to have a stable value. This is achieved by tying the value of the stablecoin to stable assets such as traditional fiat currencies (e.g. USD, EUR), gold, or other cryptocurrencies. The main goal of stablecoins is to offer an alternative to the volatility that is typical of most cryptocurrencies and to provide a stable medium of exchange, store of value, and settlement.

Tether (USDT), one of the most widely used stablecoins, differs from other cryptocurrencies in that its value is pegged 1:1 to the US dollar. This means that each USDT token issued is backed by an equivalent amount of dollars, which theoretically makes it a stable and reliable means of conducting digital transactions. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are subject to significant price fluctuations, Tether offers minimal risk of price changes, making it attractive to those seeking stability in the crypto world.

History of Tether: From Creation to Modernity

Tether (USDT) was created in October 2014 by a group of enthusiasts including Brock Pierce, Reed Collins, and Craig Sellars. The initial goal was to create a stable cryptocurrency whose price was pegged to a traditional currency — in this case, the US dollar. This was done to ensure less volatility than other cryptocurrencies, provide users with a more stable store of value, and make it easier to transact between fiat and digital currencies without having to constantly go through traditional financial institutions.

Omni Layer: USDT Launch Platform

Tether (USDT) was originally released on the Omni Layer platform, which is a superstructure on top of the Bitcoin blockchain. The platform allows for the creation and trading of digital assets and currencies based on the Bitcoin blockchain. This gives Tether a solid foundation in the form of one of the most proven and secure blockchain infrastructures.

Omni Layer uses Bitcoin transaction space to record Tether transactions, which provides a high level of security and resilience due to the decentralized and secure nature of the Bitcoin blockchain. However, this can also result in higher transaction fees and longer transaction confirmation times, especially during busy periods on the Bitcoin network.

Over time, Tether began to use other platforms such as Ethereum and TRON, which improved the scalability and availability of USDT tokens, reduced transaction costs, and faster processing times. This expansion to other blockchains allowed users to choose a platform based on their needs and preferences, which contributed to the increase in popularity and use of Tether in the crypto community.

Key events in Tether’s history have been various integrations and partnerships with major cryptocurrency exchanges, as well as the continued growth of its market capitalization, making it one of the leading players in the industry.

Disputes and legal issues

As Tether grew in popularity, it faced a number of controversies and legal issues. One of the main issues was the accusations that the issued tokens were not backed by real dollars. These accusations caused concern among investors and caused price fluctuations in the market.

In 2019, the New York Attorney General accused Tether and the Bitfinex exchange of hiding losses and manipulating the market. This led to legal battles that eventually ended in a settlement, including fines and commitments to improve reporting transparency.

How Tether Works

Tether (USDT) maintains its value equal to one US dollar through reserves, which include US dollars and other equivalents held in bank accounts. According to the company, each USDT issued is backed by an equivalent amount of traditional currency reserves, which ensures its value stability and reduces volatility.

Reserves to back Tether

Tether’s reserves include not only cash, but also other liquid assets, including corporate bonds, deposits, and even loans issued to affiliated companies. These assets serve as a guarantee of the value of all USDT tokens issued.

Tether Limited conducts periodic audits of its reserves to confirm that each USDT token is backed by the appropriate assets. However, the company has faced criticism in the past over the transparency and regularity of these audits, which has raised questions about the credibility of its financial reports.

Tether Works on Different Blockchains

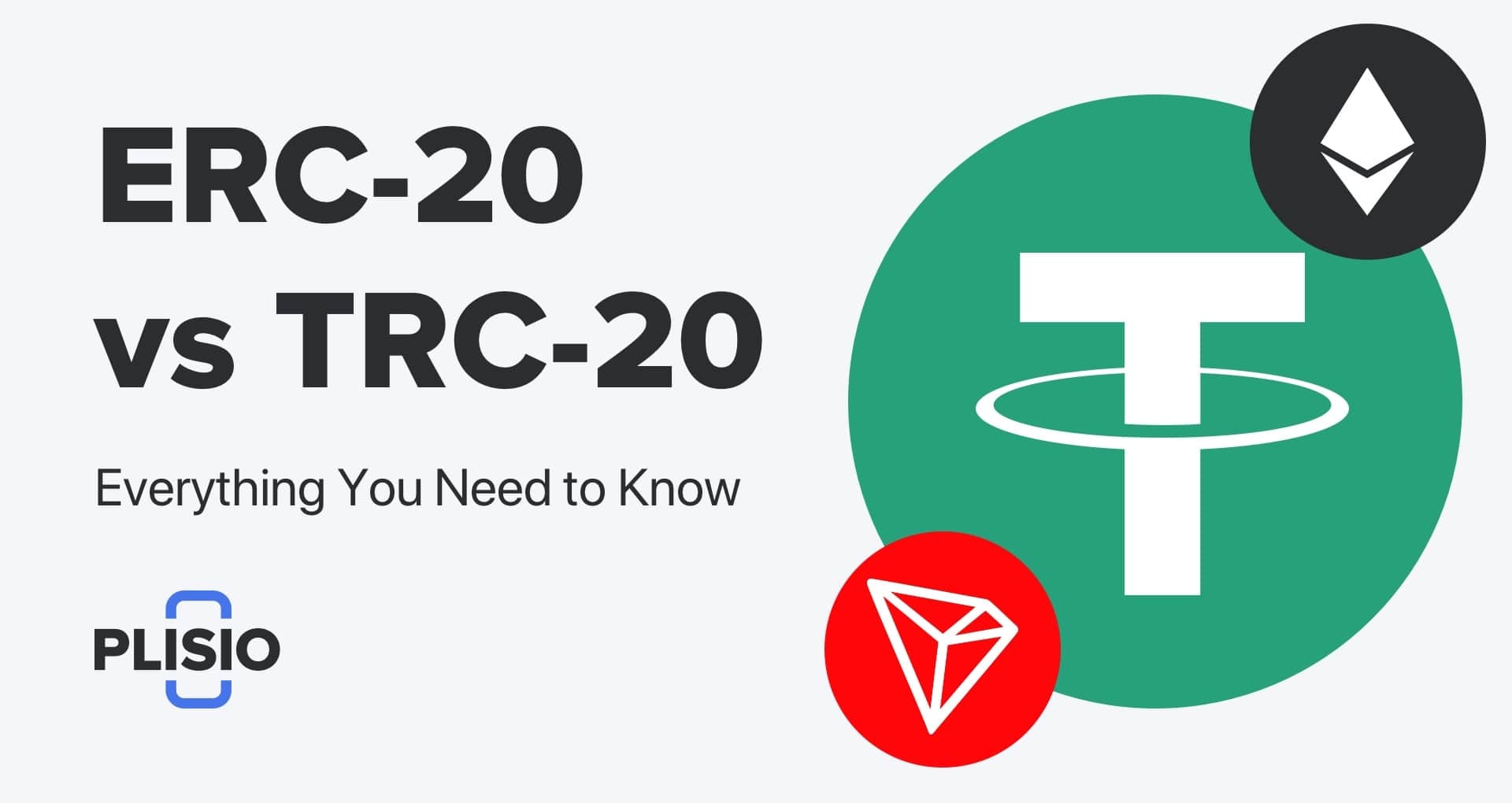

Tether is used on several blockchains, including Bitcoin (via the Omni Layer Protocol), Ethereum, TRON, EOS, and others. This allows users to choose a blockchain based on their needs for transaction speed and fees. For example, Tether on Ethereum uses the ERC-20 standard, which allows for high transaction speeds and integration with decentralized applications.

The use of multiple blockchains gives users flexibility and choice, which can improve user experience and reduce dependence on a single technology. However, it also introduces complexity in the management and integration of different versions of USDT, requiring users to be more knowledgeable and careful when exchanging tokens between different blockchains.

Tether Limited: Management and Development of Tether

Tether Limited is the company that manages the issuance and maintenance of USDT tokens. It plays a key role in maintaining reserves, conducting audits, and developing partnerships with exchanges and other financial institutions. Tether Limited is also responsible for regulatory compliance in various jurisdictions, ensuring that Tether can be legally used in the global market.

The company makes money by charging fees for transactions and USDT token exchanges, as well as through possible investment income from management.

Tether (USDT) occupies a key position in the world, offering unique advantages, but also facing certain challenges and disadvantages. Here are the main ones:

Advantages and Disadvantages of Tether (USDT)

Advantages of Tether

- Stable Price : One of Tether’s main advantages is its stability. Being pegged to the US dollar allows users to avoid the volatility that is common with other cryptocurrencies, making USDT ideal for hedging risks and preserving the value of assets in volatile markets.

- Wide availability and liquidity : Tether is supported on many of the largest cryptocurrency exchanges and is often used as a bridge between different cryptocurrencies and fiat money. This ensures high liquidity and ease of exchange.

- Use as a medium of exchange : USDT can be used to transfer money between exchanges without having to go through the banking system, reducing transaction processing times and fees.

- Support for different blockchains : Tether’s availability on different blockchains (Ethereum, TRON, Omni, etc.) allows users to choose a platform based on their preferences for transaction speed and fee size.

Disadvantages of Tether

- Transparency and trust issues : Tether Ltd., the company behind USDT, has faced criticism for its lack of transparency around how it backs and audits its reserves, raising concerns about whether each token is truly fully backed by dollars.

- Legal Risks and Regulatory Challenges : Tether has been the subject of regulatory investigations, highlighting the potential legal risks associated with the use of stablecoins in general.

- Dependency on banks and fiat systems : Despite the decentralized nature of cryptocurrencies, USDT is dependent on traditional financial systems and banks to hold reserves, introducing elements of centralized control and vulnerability.

- Market Impact : There are concerns that large-scale Tether transactions could have a disproportionate impact on cryptocurrency markets, especially during periods of high volatility.

Tether’s Use in the Cryptocurrency Industry and Beyond

Tether is often used on cryptocurrency exchanges as a middleman for buying and selling various cryptocurrencies. Due to its peg to the US dollar, Tether offers stability in an extremely volatile market, allowing traders to avoid unexpected losses during market downturns.

For traders, the main benefit of using Tether is that it minimizes volatility risk. This allows them to easily transfer profits into a stable asset, which is especially valuable during periods of rapid market fluctuations. In addition, many exchanges offer extensive trading options for USDT-based pairs, which provides high liquidity and makes it easy to enter and exit various positions.

Tether Benefits for Investors

Investors value Tether for its ability to serve as a “digital dollar.” In a volatile cryptocurrency market, USDT offers a way to preserve the value of assets without having to convert funds back to fiat currencies, which can involve additional costs or delays.

Investors use Tether not only to reduce the risks associated with volatility, but also to simplify the process of interacting with various financial instruments on blockchain platforms such as DeFi (decentralized finance). Tether can also be used to earn interest through various crypto lending platforms.

Using Tether for International Transfers

Tether enables fast and cost-effective international transfers, bypassing traditional banking systems and their high currency transfer fees. This makes it a popular choice for people sending money abroad or receiving payments from other countries.

One of Tether’s main advantages in the context of international transfers is its ability to provide fast transactions almost instantly and with low fees, which is especially important for businesses and individuals sending large amounts.

In addition to the above mentioned methods, Tether also finds use in payment for goods and services on various online platforms, games, bets and other services that accept cryptocurrencies. Its stability and widespread acceptance make it attractive for commercial transactions, eliminating many of the problems associated with using more volatile cryptocurrencies.

The Future of Tether

Tether is already widely used in the cryptocurrency industry, but there is potential to expand its use to new markets. One area where this could happen is by introducing USDT into retail and e-commerce as a means of payment, which would help it become accepted by a wider audience. Additionally, Tether could find use in developing countries where access to traditional banking services is limited, providing a reliable and stable means of storing and transferring value.

Advances in blockchain technology are opening up new opportunities for Tether to integrate with innovations such as decentralized financial services (DeFi), decentralized identity systems, and automated payment platforms. Integration with smart contracts that improve transaction functionality and security could also expand the use of USDT in automated trading systems and other financial applications.

To ensure sustainability and build user trust, Tether must actively work to address regulatory concerns. This could include increasing transparency and frequency of reserve reporting, improving cooperation with regulators in different countries, and adapting to new regulations that may be introduced in response to the growing attention to stablecoins.

Potential risks and challenges

One of the main risks for USDT is the tightening of regulatory control . Stablecoins are attracting the attention of regulators who are concerned about their impact on financial stability and potential use for illegal purposes. Adapting to strict regulations and ensuring full legal compliance may require significant effort and resources.

Issues of transparency and trust

Transparency of reserves and financial reporting remains critical to maintaining user and investor confidence. Lack of transparency may raise doubts about the sufficiency of each USDT token, potentially reducing trust and value of the token.

Technological and security threats

Like any technology that uses blockchain, Tether is subject to the risks of cyber attacks. The development and implementation of advanced security technologies to protect user assets is an integral part of the strategy to mitigate these risks.

To mitigate risks, Tether can continue to improve its governance and control systems, invest in security and technology, and actively collaborate with the community and regulators to develop standards and practices that will contribute to its long-term success and stability.

Conclusion

In the final part of our Tether (USDT) review, we can say that this stablecoin occupies a critical place in the cryptocurrency space. USDT acts as a key stabilizing element in a market where volatility often becomes an obstacle for newcomers and a barrier to widespread adoption. Tether provides traders and investors with the predictability and confidence they need, allowing them to instantly switch between volatile assets and a stable store of value without having to enter fiat currencies.

However, despite its significant advantages and widespread popularity, Tether faces a number of challenges, including issues of regulation and transparency of its trading and reserves. Like many innovative technologies, adapting to the changing financial regulatory landscape and building trust among users and regulators will be key for Tether.

Tether has already become an integral part of the cryptocurrency ecosystem, and its further development will play an important role in shaping the future of digital finance. The ability to adapt to new challenges and opportunities will determine whether Tether can maintain its position as the leading stablecoin in the global market.

Автор Alex Smith

Имеет профессиональную подготовку в области микроэлектроники и аппаратного программирования, а также более 30-ти лет опыта работы с системами обработки и передачи данных, включая оборудование для майнинга криптовалют. Готовя материал для читателей блога BuyCrypt успешно применяет свой обширный технический бэкграунд для максимально точной передачи смысла материалов с используемых источников.