An order book is a list of all active buys and sells (orders) in a market for a particular asset, showing the different price levels at which traders are willing to buy or sell. This tool helps market participants see the depth of the market, i.e. how much liquidity is available at different price levels.

History of the stock exchange glass

The order book, as a tool that displays real time orders for buying and selling financial assets, has its roots in the early days of electronic trading. In the past, when trading was conducted primarily in flashy auctions on physical exchanges, buyers had no idea what a book book in its modern form was. However, with the advent of computer technology and the transition to electronic platforms, there was a need for a new tool that would reflect all aspects of market activity in digital form.

In the 1970s, with the development of computer technology and the automation of trading processes, the first prototypes of order books began to appear. These systems were primitive compared to modern standards, but they laid the foundation for future development. In the 1980s and 1990s, with the development of the Internet and more sophisticated data processing technologies, order books became more complex and functional, providing traders with detailed information about market orders in real time.

Today, the order book is a standard tool in most financial markets, including stocks, bonds, currencies, and, of course, cryptocurrencies. Modern order books not only display buy and sell orders, but also provide analytical tools for assessing market depth, analyzing trends, and making informed trading decisions. The evolution of the order book is closely linked to the development of trading technologies and remains an important part of the infrastructure of modern financial markets, ensuring transparency and efficiency of trading operations.

The Importance of the Order Book for Cryptocurrency Trading

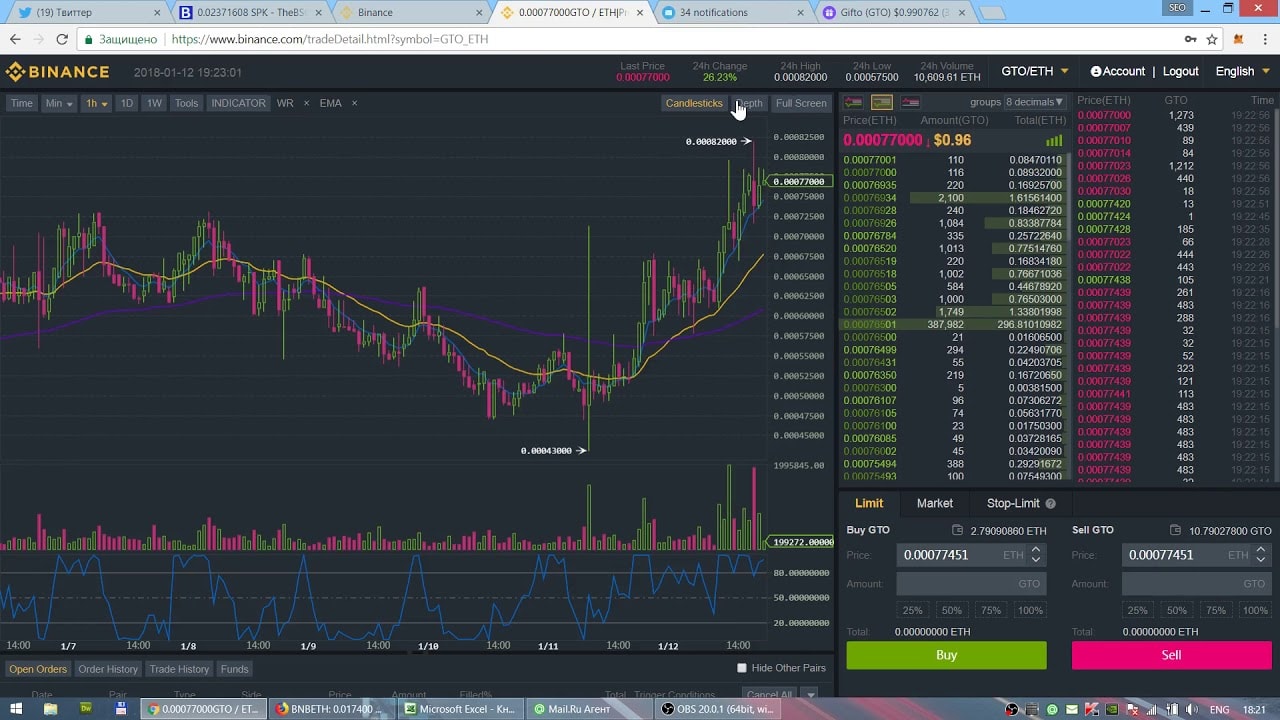

What is a crypto trading order book? A crypto trading order book plays a critical role in crypto trading because it provides deep insight into the current market conditions. This tool gives traders access to detailed information on supply and demand, showing the volume of buy and sell orders at different price levels. This allows traders to not only see where potential support and resistance levels are located, but also analyze how prices may change in the short term.

In the highly volatile environment that is typical of crypto markets, the order book becomes an indispensable tool for monitoring rapid changes in prices and trading volumes. Traders can use this information to determine when to enter and exit the market, taking into account the accumulation of orders that may indicate upcoming price movements up or down.

The order book also helps identify possible market manipulation. For example, large unfilled orders that do not correspond to the overall market trend may be a sign of attempts to influence market prices by creating false signals for other market participants. Recognizing such manipulative actions can protect traders from unprofitable trades and help avoid losses.

The use of a trading order book also helps to increase the transparency of trading operations, giving all participants equal access to information about current market conditions. This strengthens the trust in the trading platform and promotes fairer and more efficient trading.

Overall, the order book is an indispensable resource for crypto traders and traders looking to successfully navigate rapidly changing market conditions, maximize their trading opportunities, and minimize the risks associated with cryptocurrency trading.

This tool not only increases trading transparency, but also promotes deeper market insight, which is critical in the high uncertainty and risk environment that characterizes cryptocurrency trading.

Basic elements of the order book

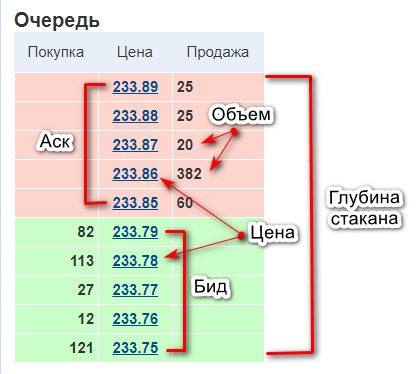

A market order book is a tool that displays current buy orders and all sell orders for a particular asset on the exchange, providing traders with important information for decision making. The main elements of a market order book include bids and asks, spread, volume, market depth, and the order book itself.

Bids and Asks

Bids and asks are price offers from traders, where bid is the maximum price a buyer is willing to pay for an asset, and ask is the minimum price a seller is willing to sell an asset for. These levels are constantly updated and change in real time depending on market activity.

Spread

Spread is the difference between the highest bid and the lowest ask. This indicator is very important, as it is the main cost of the transaction for the trader, not including commissions. Spread can serve as an indicator of market liquidity and volatility: the lower the spread, the higher the liquidity and the lower the volatility.

Volume

The volume that characterizes the order book on the exchange reflects the amount of an asset that traders are willing to buy or sell at a specific price. Large volumes at certain price levels can indicate strong support or resistance levels.

Depth of market

Market depth shows the overall picture of buy and sell orders at various price levels beyond the current bid and ask. Market depth can help traders understand potential price movements based on the presence of large orders at higher or lower levels.

Glass of quotations

The order book is a visualization of all these elements, usually presented in the form of a table, where traders can see all current buy and sell orders, their prices and volumes. This information is used to analyze market sentiment and possible market reactions to new orders.

Understanding and analyzing the basic elements of the order book can greatly improve trading strategies, allowing traders to more effectively respond to market changes and make informed trading decisions.

How to use the order book

Using the order book in trading allows for a deeper understanding of market conditions by analyzing supply and demand in real time. This tool shows where buy and sell orders are concentrated, helping traders assess potential market movement.

By watching the changes in the order book, you can identify when new buy or sell orders may indicate an increase in supply or demand, which in turn may lead to a change in price.

Identifying support and resistance levels is another key use of the order book. Levels where a large number of orders accumulate can act as barriers that prevent the price from moving further up or down. For example, a large volume of buy orders at a certain price can indicate a support level, while a significant volume of buy or sell orders can indicate a resistance level.

Finding entry and exit points for trades is also simplified by using the order book. Traders can use information about the presence of large orders to plan entry and exit points, focusing on levels where they expect liquidity to increase or decrease. This allows them to optimize their trading strategy, reducing potential risks and maximizing potential profits.

Identifying market manipulation is another important function of the order book. Watching for unusual patterns in orders, such as artificial buy or sell walls, can signal attempts to influence the market by large players. Understanding these actions helps traders avoid potential pitfalls and make decisions based on a more accurate analysis of market conditions.

Taken together, the market depth chart is a powerful tool for any trader looking to improve their trading strategies through a deep understanding of market dynamics and price formation mechanisms.

Pros and cons of using a trading order book

Using a market order book in crypto trading has its advantages and disadvantages, which can significantly affect trading strategies and results.

Benefits of using a trading order book

- Market Transparency : The order book provides a complete picture of active buy and sell orders, giving traders a clear picture of market supply and demand in real time. This allows for more accurate analysis of market trends and informed decisions.

- Identifying Support and Resistance Levels : By monitoring order volumes at various price levels, traders can identify key support and resistance levels, which helps in planning entry and exit points for trades.

- Trade Timing Assistance : Current order information can help traders choose the optimal moment to enter or exit a position, taking into account accumulated orders above or below the current price.

Disadvantages of using a trading order book

- Difficulty of interpretation : For beginners, the order book can appear confusing and information-heavy, requiring time and experience to correctly interpret the data.

- Risk of Manipulation : The order book may be subject to manipulation by large players who use so-called buy or sell “walls” to influence market movements and induce reactions from other traders.

- Impact of High Volatility : In the crypto market environment, where volatility is often very high, spreads and orders can change quickly, making the order book less reliable for short-term decision making.

While the order book can be a powerful tool for deep market analysis and improving trading strategies, it also requires traders to have the skills to properly analyze and take a conscious approach to interpreting market data.

Taking these aspects into account, traders can effectively use the order book to their advantage, minimizing risks and increasing potential profits.

Conclusion

The order book is a fundamental tool in a trader’s arsenal, providing important information about current orders, the status of buy and sell orders on the exchange. This tool reflects the real state of the market, showing trading volumes at various prices, which allows traders to better understand the dynamics of supply and demand.

Working with the order book requires an understanding of how to read and interpret the market and the data it presents.

The main task when using the glass is to analyze the market depth, which helps to determine support and resistance levels, as well as identify potential entry and exit points for trades.

Understanding the bid/ask spread is also important for buyers as it affects the cost of executing trades and can indicate the volatility or stability of market conditions.

However, it is worth considering that the data in the glass can be subject to manipulation by large players, who can create the illusion of increased demand for supply. This requires traders to take a critical approach and additionally check the information before making trading decisions.

In conclusion, the order book is not just a market observation tool, but also a powerful analytical platform that can significantly improve the quality of trading operations if used correctly.

Mastering this tool may take time and practice, but mastering these skills opens up new opportunities for effective and profitable trading.

Автор Evgeniy

IT предприниматель. Консультирую команду Buycrypt по организации децентрализованной экономики. Разрабатываю стратегию вывода на рынок ценностного предложения токена. Работаю над математическими моделями: - повышение эффективности торговли фонда методом коллективного принятия решений. - коэффициент интеллекта трейдера для расстановки весов влияния на коллективное решение. - расчет справедливости распределения доходов и вклада. - прогностический алгоритм на основе реакций масс. - система принятия решений и организация ввода/вывода активов.